.png)

Software as a service (SaaS) is generally non-taxable in the state of Colorado, but with a twist.

Colorado SaaS Sales Tax Guide

Colorado considers any software programs to be delivered via non-tangible means to be non-taxable.

Computer software purchased on a CD in a shrink-wrapped box at the big office supply store is a taxable physical item. But pre-written software delivered electronically (i.e. SaaS) is non-taxable.

However, Colorado has an unusual “Home Rule” system when it comes to sales tax. The state allows its cities to make their own decisions on issues like what they consider taxable and non-taxable.

And many cities such as Denver have seized on this opportunity to require that sellers collect the city level sales tax on SaaS. So if you make a sale to a buyer in Denver, you wouldn’t collect Colorado’s 2.9% state sales tax rate, but you would collect the 5.15% Denver rate. This downloadable PDF includes list of all of Colorado’s home rule cities.

The Colorado Home Rule System Explained

What Makes Colorado Unique

Colorado’s Constitution allows jurisdictions like cities and counties to adopt their own rules and laws on matters of local interest, and this includes sales tax laws. This includes deciding what is and is not subject to city or county sales tax rates. While Colorado is not the only state with home rule cities (and counties), it is the state with the highest amount of this type of local governance.

Major Cities and Their SaaS Tax Status

What Triggers Tax Obligations in Colorado

Businesses are required to collect sales tax from Colorado buyers if you have nexus in the state.

Economic Nexus

Economic nexus is triggered when your business makes $100,000 in retail sales to buyers in Colorado in the previous or current calendar year. If you meet this threshold, you’re required to charge sales tax to Colorado customers even if you have no other presence in the state.

Physical Nexus

Having a location, employee, contractor, or other physical presence in the state creates sales tax nexus in the state.

City-Level Nexus Considerations

If you have sales tax nexus in Colorado, then you are generally also required to collect sales tax from customers who reside in home rule cities. However, always check with each individual home rule city regarding their nexus rules.

How to Register for Sales Tax in Colorado

State Registration Process

File online at Colorado Revenue Online (choose whether you are an in-state or out-of-state retailer.) You can also mail in form CR 0100.

You’ll need:

- Business identifying information, including:

- Name

- Address

- Entity type

- Whether wholesale/retail/temporary

- Information about your products/services

- Personal information for individual officers

- Contact information

Sales tax licenses cost $16 and expire every two years.

Sales & Use Tax System (SUTS) Portal

Colorado’s SUTS system allows businesses to register and remit sales tax to Colorado as well as to a number of home rule cities that have signed up with the platform. Fortunately, large Colorado cities like Denver, Colorado Springs, and the other top 10 most populous Colorado cities have signed up for SUTS. This means your business will not be required to file separate sales tax returns in many of the most populous Colorado cities.

Important to note: Register with the state before registering for SUTS. SUTS then imports your information seamlessly.

City-by-City Registration

Home rule cities make their own rules, but generally require that businesses who make taxable sales into the city register for a sales tax permit in that city.

Note that for remote (non-Colorado) sellers, most home rule cities follow the state’s precedent that $100,000 in the previous four quarters creates sales tax nexus. However, you should always check with the individual home rule city to be sure you don’t owe sales tax.

Calculating the Right Tax Rates

If you have nexus in Colorado, you’re required to collect sales tax on all Colorado transactions. Home rule cities that make their own rules around what products are taxable make this complicated. Here’s how to untangle the knot.

If what you are selling is taxable in Colorado, then you’re required to collect the 2.9% Colorado state sales tax rate. Things get more complicated when it comes to home rule cities.

Let’s take the home rule city of Denver as an example. This is their combined sales tax rate:

If you sell a taxable item like a toothbrush or book to a person in Denver, you’d charge them the combined 9.15% sales tax rate since toothbrushes are taxable in Colorado and in the home rule city of Denver.

However, SaaS is not taxable at the state level in Colorado. So in this case, you wouldn’t charge the Colorado state rate, nor the special taxing district rates. Instead, you would charge your customer the 5.15% Denver city rate when selling them your SaaS product.

Common Calculation Challenges

The most common challenge for SaaS businesses when it comes to Colorado sales tax is tracking where your products are taxable. Like in the example above, SaaS isn’t taxable at the state level, but it is taxable in Denver. But it may not be taxable in other home rule cities, like Lakewood, Colorado’s 5th largest city by population.

Failing to charge enough sales tax can lead to you being required to pay out of pocket (with fines and penalties on top of that.) Collecting sales tax where you aren’t supposed to can lead to the administrative hassle of refunding or paying that excess collected to the state. Not to mention that if your customer is a savvy taxpayer, they won’t be too happy to pay extra.

Sphere calculates the right sales tax rate every time. Get a demo of Sphere today!

Filing and Remittance Requirements

State Filing Requirements

Sales tax is due in Colorado on the 20th day of the month after the end of the taxable period.

Filing sales tax in Colorado requires first determining how often you need to file based on your monthly sales tax collection. If you collect $15 or less per month, you can file annually (due January 20). For collections under $600 per month, quarterly filing is permitted with specific due dates for each quarter. Businesses collecting $600 or more monthly must file monthly returns by the 20th day of the following month.

Businesses collecting more than $75,000 in state sales tax annually must pay via Electronic Funds Transfer (EFT), and wholesale businesses with sales tax liability of $180 or less per year can file annually.

Remember that if the 20th falls on a weekend or holiday, your deadline shifts to the next business day.

Colorado tax filers can opt to use Colorado Revenue or, if you need to file in multiple home rule cities, the state’s simplified SUTS system.

SUTS Filing Process

For state sales tax as well as for most localities in Colorado, you’ll be able to use the Sales and Use Tax (SUTS) system to file.

While SUTS is a lot more streamlined than the older system, which entailed filing a sales tax return with each and every home rule city, it still has its issues. It requires an Excel spreadsheet upload, for one. And if you make a mistake, such as forgetting to put $0 in localities where you didn’t collect any sales tax, the state will badger you to correct it. This nitpicky system also makes claiming deductions difficult.

Need helping filing SUTS? Sphere has your back. Never look at another Colorado sales tax spreadsheet again. Automate with Sphere instead!

Non-SUTS City Requirements

Some cities haven’t opted in to SUTS. If you are registered and make sales in non-SUTS cities, then you’re required to file in each individual city on top of your SUTS return. This means registering and remembering a new password, and in some instances even paying by old fashioned paper check.

Fines and Penalties

A penalty of $15 or 10% of the tax due (whichever is greater) will be assessed for late filing and/or payment. And an additional .5%, not to exceed 18%, will be assessed monthly until the fine is paid. Interest accrues on the balance until it is paid in full.

How to Avoid a Colorado Sales Tax Audit

Colorado tax compliance is more complex than most states, which can leave even the most conscientious business open to an audit. To avoid an audit, be sure to:

- Save 3-4 years of transaction data – Colorado audits typically look back three years. In the most serious cases, your auditor will evaluate your tax collected transaction by transaction, so be sure you can prove your compliance at the most granular level. Learn more about the Colorado sales tax audit process here.

- Support taxability decisions – Keep correspondence or be ready to stand behind decision making when it comes to why you chose to collect tax (or not collect tax) on specific products or transactions. Be especially careful to document your decisions regarding home rule cities.

Exemption certificates – Collect exemption certificates from any buyers who claim they are buying for resale and make sure to collect an updated certificate from repeat buyers annually. Be sure to validate the authenticity of any resale certificate before accepting it.

Special Considerations for SaaS Companies

There’s a reason Colorado is considered “sales tax on hard mode” even by tax experts. Product taxability determinations are tough, and you need to check the taxability of your products in every new home rule city you sell in. Further, as your business gains traction in the state, you may find yourself filling out multiple city-level sales tax filings per tax period–each with their own way of doing things.

.png)

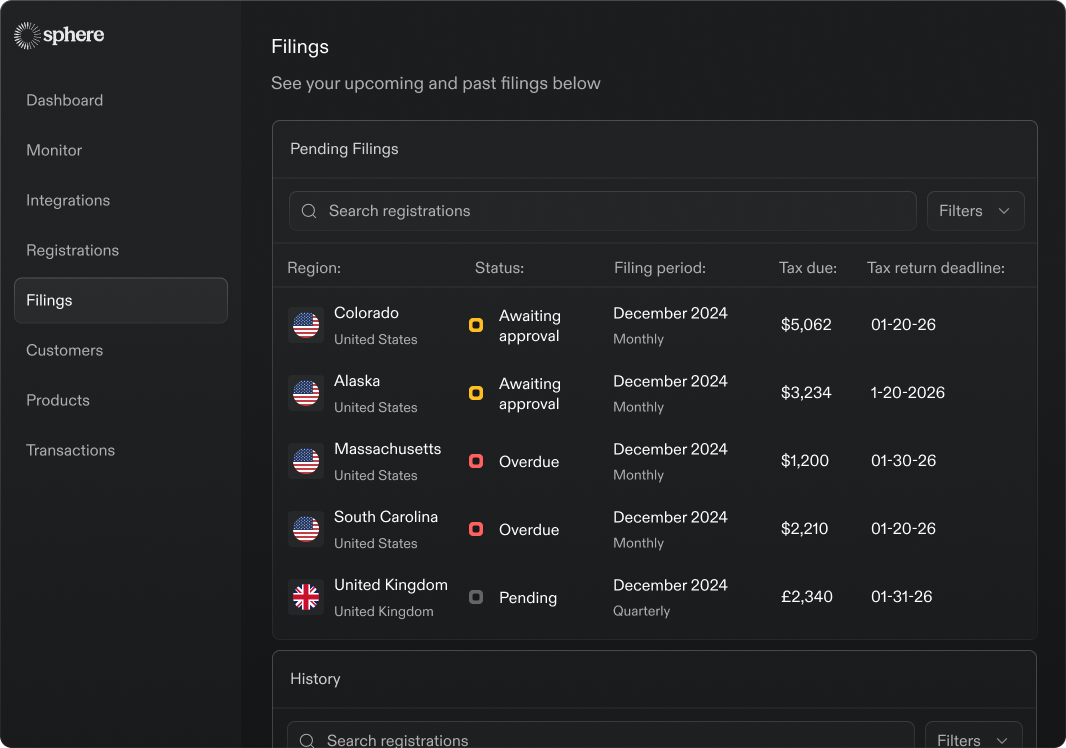

How Sphere Simplifies Colorado Sales Tax Compliance

No time for sales tax? Especially when it comes with a complex administrative burden of filing multiple sales tax returns in a single state per period? And spreadsheets on top of that? Sphere has your back.

With Sphere, you get:

- Automated Sales Monitoring - Sphere knows where your customers are, lets you know if you need to register for a new permit or remit sales tax in a new home rule city.

- Smart Colorado Sales Tax Collection – Always collect the right sales tax rate, at both the state and local level. No under collecting and paying out of pocket, or over collecting and earning unhappy customers.

- Easy Colorado Sales Tax Registration - Register with the state, and keep track of all of your sales tax registrations in one user-friendly place.

- Hands-Off Filing - Sphere syncs with both Colorado Revenue and SUTS so you don’t need to learn and keep track of multiple systems. Returns are generated for you in the (tricky and nitpicky) way that Colorado wants to receive them.

Colorado sales tax is messy, but you don’t have to deal with it alone.

.png)

.png)