.png)

What Is a VAT Number?

Value added tax (VAT) is a consumption tax levied in about 175 countries, including the UK and European Union. In order for businesses to legally conduct business in countries with VAT, they generally need a unique tax ID called a VAT number.

As a US business looking to expand into the EU, it’s vital to understand when you need a VAT number and what VAT registration entails.

Why a VAT Registration Number Matters

Though VAT rules vary, businesses selling to buyers in a country are generally required to comply with indirect taxes (i.e. sales tax, VAT, or GST in Australia) in that country.

Having a VAT number means a business is compliant with that country’s tax system, and that they can both charge VAT and, in some cases, claim credit for VAT paid. For sellers of physical goods, if a non-EU business is not registered for VAT customers may be liable for extra fees before taking delivery of their items.

Who Needs to Register for VAT?

In general, if doing business in a country with VAT, you’ll need a VAT number. In the EU specifically, if your sales of physical goods to customers in EU member nations exceeds €10,000 annually you must register for VAT. If you sell digital goods, such as digital products or SaaS, you’re required to register as soon as you begin selling into the EU.

Though there are sometimes exceptions depending on how much you sell or your customer type.

VAT Thresholds: B2B & B2C

In most cases, businesses that sell directly to consumers are required to register and start collecting VAT as soon as they begin selling to buyers in that country.

However, if you sell exclusively B2B you may not be required to register and collect VAT. Instead, your business customer may be liable for paying the VAT, which they can then claim as a credit on their own VAT filings. In this case, a VAT number isn’t always needed.

Voluntary Registration

Some businesses choose to voluntarily register and obtain a VAT number even if you haven’t yet met the country’s minimum requirements. For one, this makes financial sense and allows a business to reclaim VAT paid to other businesses. Further, it can build trust and facilitate doing business, because it doesn’t require explaining to business customers why your business isn’t registered and that the onus of paying VAT is on them. And last but not least, it can be a preemptive measure for businesses who are projected to hit the country’s VAT requirements.

How to Get a VAT Number

Step 1 – Choose Where to Register

First, determine where your business is required to register. Each country issues individual VAT numbers, and the registration approach varies significantly depending on what you sell and where you have business presence.

Using the EU as an example:

For Digital Goods and SaaS

If you're selling software, digital services, or other digital products, your registration strategy depends on your physical presence:

- No EU Presence – Apply for the Non-Union One Stop Shop (OSS) scheme, which allows you to file and remit VAT through a single EU member state (most businesses choose Ireland). With Non-Union OSS, you receive a Tax Reference Number (TRN) rather than individual VAT numbers, and can handle VAT obligations across all EU member states through one simplified process.

- EU Presence – If you have employees, an office, or other physical presence in an EU member state, you must first register for a VAT number in that specific member state, then use the Union OSS scheme to handle VAT for sales to other EU countries.

For Physical Goods

Physical product sellers face different requirements, especially if you have a physical presence or store goods in a store or warehouse in the EU:

- Low-value goods (under €150) – You can use the Import One Stop Shop (IOSS) for simplified VAT handling on imported goods to consumers.

- Higher-value goods or EU storage – You must register for individual VAT numbers in each EU member state where you store inventory, plus use the Union OSS scheme to remit VAT for sales to other member states.

Step 2 – Prepare Documents

How to register for a VAT number can vary significantly per VAT country, but for the registration form you’ll generally be required to provide:

- Business identifying information – Name, address, contact info, incorporation documents, tax identification number, etc.

- Owner/Officer information – Names and identifying info for all owners and parties with a significant stake in the company.

- Sales information – Including what you sell, your customer type (business or consumer), and even projected sales amount.

Step 3 – Submit Application

Most countries have an online registration portal. Initial registration can take anywhere from a few minutes to an hour. Some countries send multiple follow ups before registration can be fully completed. If registering yourself, be prepared to wait days or weeks before receiving your VAT number.

Some countries, like Australia and Singapore, offer simplified registration for non-resident sellers.

Step 4 - Verify and Use your VAT Number

Once you’ve registered, first verify that your VAT number is active. You can validate EU VAT numbers by entering your number into the VIES VAT Number Validation website.

From there, be sure to update your invoices (which allows customers to claim credits) and accounting tools. For example, if you use Stripe for billing, enter your VAT number and Stripe will provide that info to customers on invoices.

Once registered, you’ll need to collect from your customers. VAT rates and rules vary by country.

Country-by-Country VAT Difficulty Table

Note: This table reflects the most popular VAT countries among Sphere users.

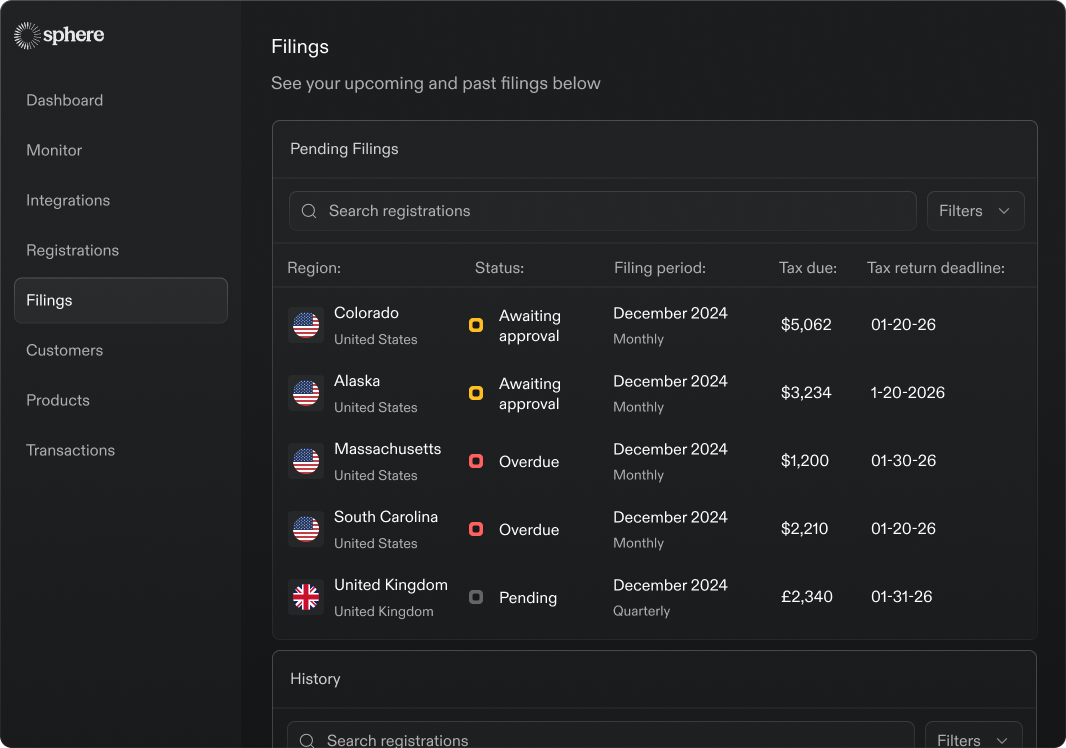

After Registration: Filing & Paying VAT

VAT Returns

VAT returns are generally due quarterly, though you should always check with the local taxing authority on your particular due date. Most countries provide a portal where you can login and pay. If you’ve registered through the EU OSS or IOSS, then you can file a return and pay your tax for all EU member states through one member state .

Making VAT Payments

Payment is generally due at the same time as filing your tax returns. Typically it is on the last day of the month following the period end date. Payment method, currency and deadlines vary by country. If you don’t have a local bank account, you may be asked to pay via wire or even have a local representative handle the payment through an in-country bank or financial institution.

Record-Keeping

To remain VAT compliant, a business must keep detailed records down to the granular transaction level. It’s recommended to keep all records for 10 years, as some countries reserve the right to look back that far into your financial records should your tax practices be audited or investigated.

Penalties for Non-Compliance

Most tax authorities have penalties for non-compliance as well as not filing or paying on time. These vary by country, but can be steep. They will often involve a flat fine as well as interest on the outstanding tax liability. For example, South Korea imposes a standard 20% penalty on underpaid VAT amounts, with additional interest accruing at 8.03% annually.

VAT for Non-EU Sellers

The EU operates three separate one-stop-shop programs depending on what you sell and where your business has physical presence.

- IOSS (Import One Stop Shop) – For physical goods providers with no physical presence in the EU selling goods valued at less than €150 to consumers.

- Non-Union OSS – For digital/intangible goods providers with no physical presence in the EU (such as SaaS companies, digital content creators, etc.).

- Union OSS – For companies with a physical presence in the EU selling to other EU member states, regardless of whether they sell physical or digital products.

Non-Union OSS For Digital Businesses

As stated above, US-based SaaS companies and digital service providers typically use the Non-Union OSS program. During registration, you choose which EU member state to register through (most businesses choose Ireland). This gives you a Tax Reference Number that allows you to handle VAT obligations across all EU member states through one simplified process.

IOSS Limitations for Physical Goods

The IOSS is designed specifically for non-EU sellers of physical goods valued under €150. Businesses selling higher-value physical products must register for individual VAT numbers in EU countries where they store inventory, plus use the Union OSS for cross-border sales.

Reverse Charge & Validation

If you solely sell B2B, you may not be required to register for VAT at all. Instead, you can apply the “reverse charge” mechanism and put the onus of paying VAT onto your EU customers.

To do this, you must ensure your buyer has a valid VAT number and include on the invoice that the reverse charge mechanism applies. In this case, your customer will generally “pay” the VAT but then claim credit for the VAT paid to you, a non-registered business.

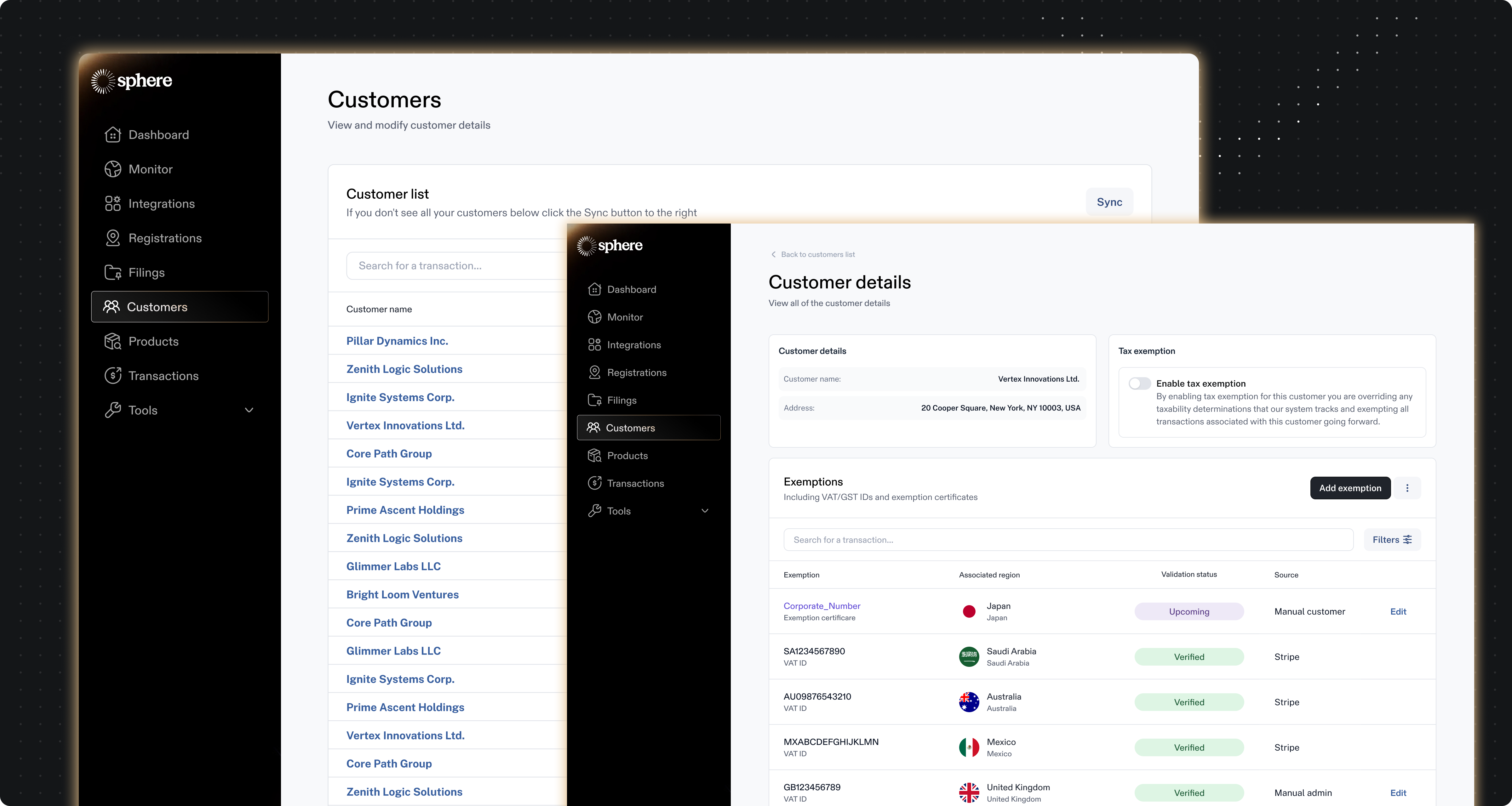

How Sphere Helps with VAT Compliance

US businesses have already learned a whole sales tax system. Learning a new one, VAT, can sound daunting. That’s where automation comes in.

Sphere, the AI-powered global sales tax compliance solution, simplifies VAT by:

- Automating Registration – Register your business with the IOSS or individual countries. No wrestling with online portals.

- Filing VAT – File and pay on time to avoid fines and penalties.

- Tracking compliance thresholds – Not all countries require a business to register from day one. Sphere lets you know when your business is approaching a compliance threshold and must register.

- Complying across multiple countries – Most indirect tax automation works with the US or the EU. Sphere works with both, and the other large global markets. When you start your tax automation with Sphere, there’s no need to change solutions as your business grows.

.png)

.png)