.png)

Vertex, Avalara, or a Modern Sales Tax Compliance Solution?

Vertex and Avalara are the key legacy players in the sales tax compliance space, but with that legacy comes high prices, technical debt, and outmoded ways of doing business.

That’s where modern, technology-forward solutions like Sphere enter the picture. Find out how these solutions stack up on pricing, user-friendliness, automation, global coverage and customer support.

What Is Avalara?

Overview & Core Features

Founded in 2004, Avalara is a legacy solution for sales tax compliance. With their AvaTax API tax collection engine, they power the sales tax collection of many e-commerce companies. They also offer return filing and remittance services, exemption certificate management, and integration with some online shopping carts, marketplaces, and enterprise resource planning apps (ERPs).

Pros & Strengths

- Longevity - As the oldest player in the field, Avalara has had time to build up a comprehensive knowledge database on sales tax rates, rules, and laws in all 14,000 US taxing jurisdictions. They’ve also had the time to build up a library of software integration partnerships as well as tax advisors.

- Automation options - Their automated filing and remittance solutions are comprehensive and sometimes even cover different tax types beyond sales and use tax. They also offer different solutions for different sized businesses, including limited lower tiers for new businesses.

Cons & Limitations

- Longevity (again) – While Avalara is a long-established player in the space, their longevity contributes to some drawbacks. Because they were founded in a time before tax automation and AI, as well as big sales tax changes like the South Dakota v. Wayfair Supreme Court case, their solutions can feel dated and cobbled together rather than streamlined.

- Unreliability - The company experienced a major setback when their calculation engine crashed during Cyber Monday, leaving e-commerce retailers unable to process sales during one of the year's most crucial shopping periods. Adding to uncertainty, after a short stint as a publicly traded company on the NYSE, Avalara was acquired by Vista Equity Partners in 2022, ending its public market journey.

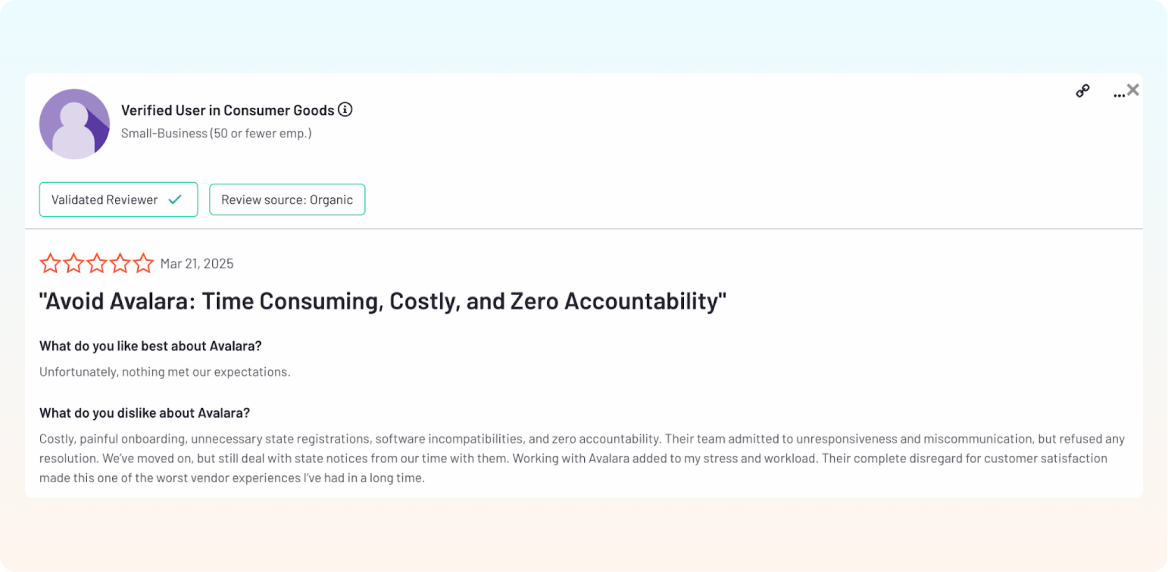

- Vocally unhappy customers - User reviews reveal other issues. Users complain about ease of use of the product. Their pricing has been described as confusing and unintuitive, with what is marketed as a straightforward monthly fee actually laden with per-transaction charges, hidden overages, and contract termination penalties.

- Limited international support - Further, for international businesses, their global support has turned out to be less robust than advertised. Customers report that the coverage falls short, and that instead of a native solution Avalara recommends a network of local advisors to assist in international tax compliance.

- Limited automation - The promise of complete automation also seems to fall short, according to customers who report still needing to perform hours of monthly manual work on their end to remain tax compliant. This includes integration limitations, with many reporting that their own staff were required to put in the technical work to integrate with Avalara’s systems.

- Painful onboarding process - The onboarding process has been another historic pain point, with customers describing getting started with the software solution as unnecessarily slow and resource-intensive, often requiring multiple meetings. Worse, they also describe little support post-implementation, with no dedicated account managers beyond the initial sale and slow response times (up to weeks) to post-purchase issues.

The widespread complaints highlight why many businesses seek a more modern and streamlined solution to sales tax compliance.

What Is Vertex?

.png)

Overview & Core Features

While Avalara attempts a solution for all, their core competitor, Vertex Inc., founded in 1978, bills themselves as the enterprise-level solution, with their 40 years in the industry focused on Fortune 500 companies and their ilk.

With that background, it's no surprise that Vertex serves some of the world’s largest companies, and has long experience dealing with complicated sales tax regulations and indirect tax scenarios, both in the US and abroad.

Vertex also offers enterprise-grade integrations with large ERPs like Oracle or Netsuite, though that breadth and experience also comes with an enterprise-sized price tag.

Pros & Strengths

- Handles complex tax requirements – Stemming from their expertise in enterprise tax compliance, Vertex is known for their ability to handle complex tax compliance needs, both in the US and abroad. The same customer focus has led them to establishing integrations with SAP, Oracle and the other leading ERPs trusted by large, international companies.

- Customer satisfaction – With a strong reputation for accuracy and few complaints about hidden fees or lack of support, they also generally pull in higher customer satisfaction ratings than their competitor Avalara.

Cons & Limitations

- Built for big businesses – Vertex’s biggest pro leads to their biggest con. They are built for large businesses with especially complex tax needs, leaving small businesses out in the cold. Their core customer also has a dedicated tax team, so Vertex doesn’t focus on the automation or usability key features that make other modern tax compliance solutions so user-friendly. This includes not fully managing all aspects of sales tax filing and remittance, because their target customers typically have that expertise in-house.

- High-priced - Vertex is also very expensive, with a price point beyond most businesses. This solution was simply not built for small, medium, and growing businesses. Businesses who don’t have designs on being publicly traded on the NYSE or the Nikkei will want a solution with a more user-friendly interface and a much lower price point.

Limited AI expertise and experimentation – Being a larger, older company, Vertex has been cautious in rolling out any new AI-based features in their product offerings. This could lead to them falling further behind in the technology race, allowing competitors like Sphere to offer the same solutions for a fraction of the price.

Where Both Fall Short — And How Sphere Fills the Gap

The Problems with Legacy Tools

In 1978 when Vertex was founded, most sales transactions still took place face to face or via mail and fax. By 2004 when Avalara arrived on the scene, e-commerce was just in its infancy. Software as a service (SaaS) wouldn’t be a common term for years yet. The iPhone was just being conceptualized, and people were using their mobile phones to play Snake, not make purchases.

With legacy tools, you get:

- Complexity – these tools were built for outdated ways of doing business.

- High costs – old ways of doing business, built-in complexity, and technical debt leave these solutions at a higher price point than many newer businesses can afford.

- Manual research processes – legacy solutions have teams of tax experts who manually research tax rules and laws, adding to costs and lowering efficiency.

- Extended implementation time and use of your resources – customers of both Avalara and Vertex complain that implementation takes weeks or months and still requires in-house manual work even after setup.

- Not focused on fast growing tech businesses - these tools are product agnostic and don’t go deep on the nuances of SaaS, on-premises software, digital goods, etc.

While legacy tax compliance tools have their place, we’re fortunate to now live in a world where modern solutions tackle modern problems, and for a fraction of the price of the historic major players.

Why Sphere Is Different

.png)

Sphere is the first modern tax compliance solution built specifically for SaaS and AI companies. And the difference between Sphere and legacy solutions couldn’t be clearer. Sphere is already trusted by industry leaders like ElevenLabs, Replit, Codeium, and Runway AI.

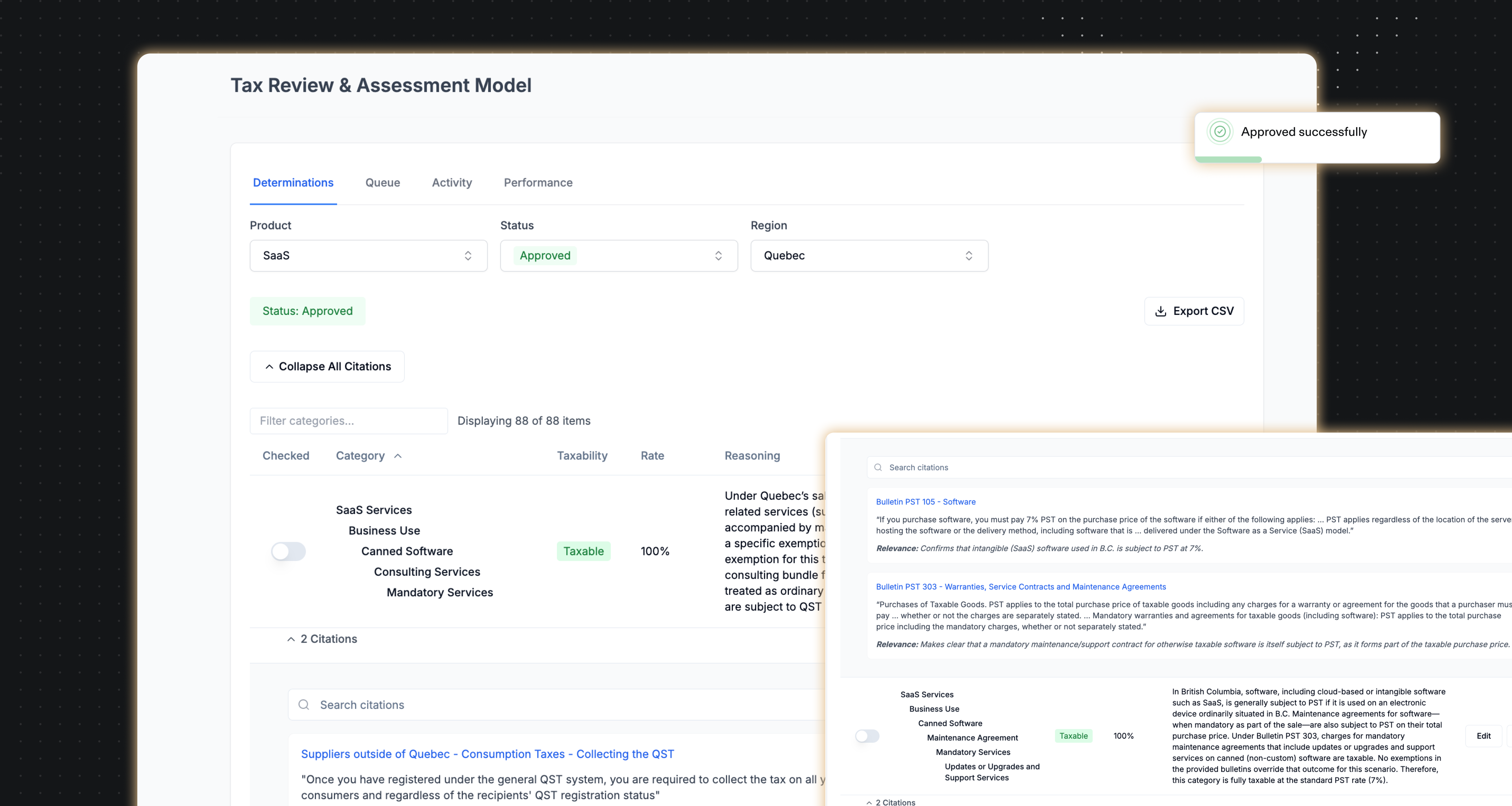

It’s the only solution that natively supports both US and international VAT/GST tax compliance. Rather than requiring ramp-up or expensive international add-ons, Sphere allows for international sales tax collection from day one. No patchwork solutions, no third party tax advisors, just comprehensive coverage wherever you sell.

Sphere also doesn’t bake expensive international tax consultants into the price. Instead, their AI-forward tax engine enables always-accurate tax collection with automated updates. Tax compliance means digesting and implementing ever changing international tax law–and it’s a perfect use case for AI. With Sphere, your business never misses a new tax law or rate change.

Speaking of price, with a transparent flat-fee $100 per region per month pricing model, Sphere is easy to fold into the budget. Your tax engine doesn’t do any additional work as you grow in volume, so why should you pay more as you grow? And there are no hidden fees or onerous long-term contracts.

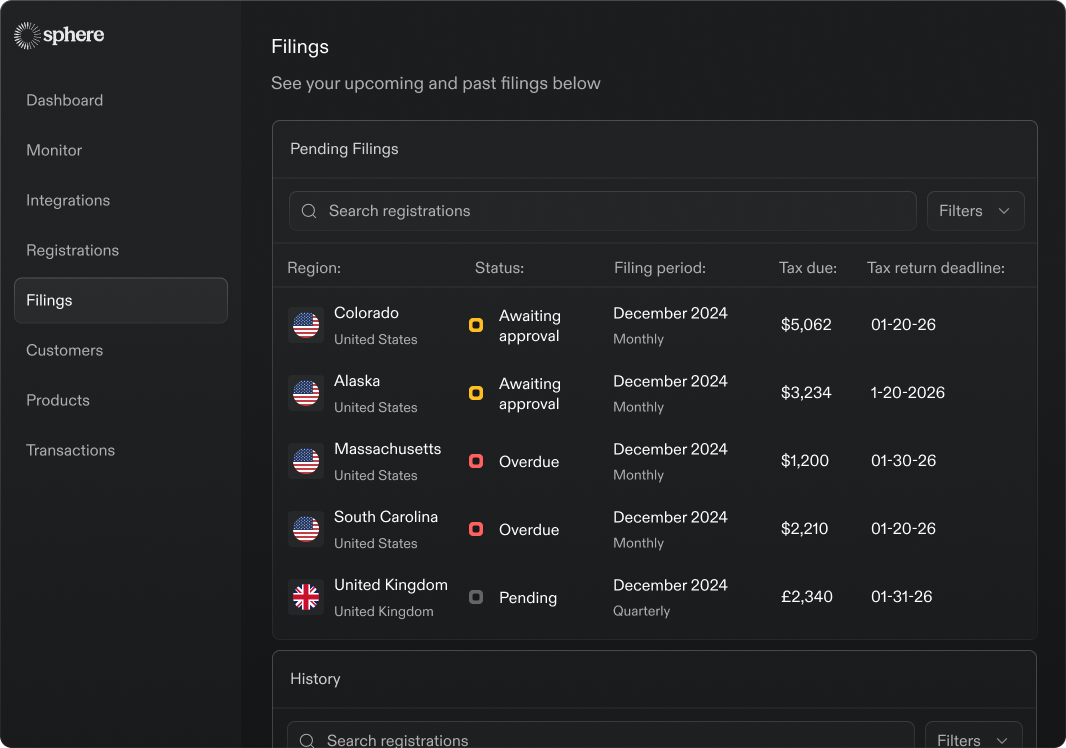

Sphere’s modern user experience also allows for simple, self-service onboarding. Get started in minutes, not weeks or months as with the legacy solutions like Avalara and Vertex. And never be left hanging, because sales and other indirect taxes don’t wait for you to catch up. Onboarding is also aided by the fact that Sphere integrates with modern billing solutions and tech stacks. Whether during onboarding or during the normal course of business, Sphere customers report superior customer support, always within a day and usually within just hours.

Sphere may be a newer entry into the tax compliance space, but it's also the only current solution that natively handles both the complexities of US sales tax as well as VAT and GST globally. Sphere is a true alternative to the US-focused, manual-work required tax solutions currently dominating the market.

Avalara vs Vertex vs Sphere: Feature & Pricing Comparison

Here’s how Sphere stacks up to legacy tax compliance software solutions:

How to Choose the Right Tool for Your Business

You may be paralyzed with choices when it comes to choosing a tax compliance tool. Or maybe you’ve already committed to a solution, and the thought of repeating the lugubrious Avalara or Vertex onboarding processes has you suffering from flashbacks.

Let’s simplify your tax compliance decision by offering up a few questions to ask before you make your choice.

Questions to Ask Before You Commit

- What countries and tax systems do you support?

- I sell or plan to sell internationally. Do you have that expertise in-house or do you use a network for advisors?

- How quickly do you scale with my business? (I.e. If I start selling in a new country, how long do you need to keep up with my operations?)

- What should I budget for your service? Please provide a full breakdown of pricing and any additional fees I might be charged.

- Our business uses a tech stack that works for us. How will you go about integrating with it? How long does it take? What technical resources do we need to provide?

- How do you keep up with changes in tax law or product taxability? Do you monitor periodically using tax teams or in real-time via an automated system?

Satisfactory answers to those questions should make the choice clear.

When to Choose Sphere

Sphere is the ideal choice for SaaS and digital product companies operating globally or planning international expansion. It’s perfect for teams wanting compliance without hassle, offering predictable flat-rate pricing and stellar customer support.

If you’re using modern billing systems like Stripe or Chargebee and value AI-powered accuracy that eliminates the pitfalls of manual research, Sphere delivers the most modern and forward-thinking solution on the market.

Final Verdict: Sphere vs Vertex vs Avalara

We may be a little biased, but we are willing to give credit where credit is due. If you are a Fortune 500 company with extremely complex global tax needs and a bottomless compliance budget, then Vertex may be for you. And if you are a medium or large e-commerce business, then Avalara’s legacy sales tax collection, filing and remittance solution might do the trick.

However, do you have better ways to spend your and your stakeholders’ money than on tax compliance solutions? Enjoy Sphere’s flat-rate, no-surprises pricing.

Want friendly customer support when you need it, not days or weeks from now? Sphere has that in the bag, too.

And especially, if you are building a modern, growth-minded business that doesn’t plan to limit yourself to selling within US borders, then Sphere is the tax compliance solution for you.

.png)

.png)

.png)

.png)