.png)

SaaS businesses selling into Norway may be caught off guard by the complexity of Norway’s indirect tax.

Unlike its European neighbors, Norway is not part of the European Union (EU). For SaaS businesses selling into Norway, this means navigating a stand-alone tax scheme rather than taking advantage of the EU’s One-Stop Shop (OSS) VAT system.

For growing SaaS and AI companies expanding into Nordic markets, Norway's unique tax landscape presents both significant revenue opportunities and substantial compliance challenges. The combination of high value added tax (VAT) rates, strict documentation requirements, and the absence of familiar EU simplifications means that businesses accustomed to streamlined European tax management need to approach Norwegian VAT with extra preparation and the right compliance strategy.

Is There Sales Tax in Norway?

Norway doesn’t have a US-style sales tax. Instead, it uses Value Added Tax (VAT) with a 25% standard rate–one of the highest tax rates in the world.

For businesses selling into Norway, even if you only sell non-tangibles like SaaS or digital goods, it’s vital to understand and comply with Norway’s unique tax system.

Understanding Norway's VAT System

Why Norway Has One of the World’s Highest VAT Rates

Norway offers some of the world’s most comprehensive services like universal healthcare, higher education, parental leave, and child and elderly care, and they pay for that partially with their nearly-universal 25% VAT rate. Further, since they are part of the European Economic Area (EEA) but not part of the EU, they preserve the autonomy to set their own VAT rates.

For businesses selling to customers in Norway, this means negotiating a complex tax system rather than taking advantage of the neighboring EU’s more streamlined tax scheme for international sellers.

VAT vs. Sales Tax: What SaaS Companies Need to Know

Branching out from selling in the US can be a bit of a culture shock for US-based businesses. US sales tax is charged at the final point of sale to the end user of a product. B2B sales are not taxable under the US system.

But with VAT, sales tax is charged at every stage of the supply chain, from the raw goods provider, to the manufacturer, to the wholesaler, etc. At each stage of the chain, businesses can reclaim VAT they paid on prior purchases through input tax credits. This creates a system where businesses are incentivized to both properly charge and claim VAT where applicable.

VAT Registration Requirements in Norway

Foreign businesses with no physical presence in Norway are required to begin collecting VAT from consumers in Norway as soon as they hit 50,000 NOK (about $5,000 USD or €4,500 EU) in any 12-month period. This means it's vital to track your sales into Norway and register for VAT as soon as it’s clear you’ll hit that threshold.

Norway’s Two VAT Registration Schemes Explained

Depending on how you do business in Norway, you may be required to register for standard VAT or you may be eligible for the simpler Value-Added Tax on E-Commerce (VOEC) VAT scheme.

Standard VAT Registration:

Businesses with physical presence in Norway or making more than 50,000 NOK in taxable turnover must register in Norway using Standard VAT Registration. Businesses who wish to claim input VAT credits must be registered under this scheme.

This complex registration process requires a local representative in Norway as well as legal paperwork such as a power of attorney. Other required documentation includes Articles of Incorporation, bank letters, and passport copies.

Once registered, businesses on the Standard VAT scheme are required to file and remit all collected VAT to the Norwegian Tax Administration every other month (bi-monthly).

Getting VAT compliant in Norway is not a quick or simple process, so businesses who predict making 50,000 NOK in any 12-month period should plan ahead for Norwegian VAT registration.

Value-Added Tax on E-Commerce (VOEC) Scheme

This simplified tax scheme was designed specifically for e-commerce, software companies, and marketplaces with no physical presence in Norway and less than 50,000 NOK in taxable turnover.

To facilitate the flow of business, VOEC registration is much simpler, and only requires:

- Company’s effective date of registration

- Company’s tax identification number

- Business’s contact details

Unlike with Standard VAT, no local representative is required.

Companies registered under this scheme are required to report and remit quarterly. Because of the simplified reporting system, businesses under this scheme cannot claim VAT input credits.

VAT Calculation for SaaS Companies

B2B vs. B2C Sales Distinction

Whether or not to charge VAT in Norway depends on your customer.

For B2C sales, businesses are generally required to simply charge the 25% VAT on all sales, unless the items sold are taxed at a lower rate or exempt.

For B2B sales that are registered for Norwegian VAT, you can apply the reverse charge mechanism as long as the business buyer provides a valid Norwegian VAT ID. In this case, you, as the seller, can issue a reverse charge invoice and the buyer will take on the tax liability. Note that small businesses may not be required to register for VAT yet. In this case, you’d charge them the Norwegian VAT rate of 25% as if they were a consumer.

When applying the reverse charge in Norway, it’s important to note that your customer must have a Norwegian VAT ID. Though it’s a common error, an EU VAT number is not considered valid.

Reduced VAT Rates and Special Cases

Most transactions are taxed at the country’s standard 25% VAT rate.

However, some items are taxed differently.

The following are taxed at 15%:

- Food and beverages (excluding tobacco and food consumed in restaurants and other dining establishments)

- Alcoholic beverages

- Medication

- Water from Waterworks

The following are taxed at 12%:

- Domestic passenger transport services

- Transport of vehicles (including ferries)

- Accommodation

- Cinema, museum, and gallery tickets

- Amusement park tickets

- Sporting events

Always keep track of exactly how much VAT you charge on each transaction. For businesses exceeding the 50,000 NOK threshold, transaction-level details are required for every tax filing.

VAT Filing and Compliance Process

Norwegian VAT filing complexity depends on how you are registered.

Standard VAT Registration Returns

Filing VAT returns under Norway’s Standard VAT Registration is administratively complex. Businesses must provide all transactions and invoices (in PDF format) to their local representative. Filings are due every two months (bi-monthly).

VOEC Scheme Filing

Filing under the VOEC Scheme is very simple. All that is required is a report of your gross sales for the period and remittance of any VAT due. This information is directly submitted to the Norwegian Tax Administration and no in-country representative is required. VOEC filings are due quarterly.

Norwegian VAT Payment and Remittance

Under both tax schemes, you’ll be required to submit payment to the Norwegian Tax Administration via wire transfer.

Penalties and Compliance Risks

Norway strictly enforces VAT compliance. Penalties for late VAT filing and payment can be severe.

First, a late VAT return triggers an “enforcement fine” of ½ “court fee” per day—657 NOK in 2025—capped at 50 court fees (or a total of 65,700 NOK) for the period.

Once the past-due tax is assessed but not paid, statutory late-payment interest accrues (12.5% for the first half of 2025, adjusted every six months). Beyond that, the authority can impose an “additional tax” penalty equal to 20% of the unpaid VAT.

If the tax authority finds gross negligence this penalty is 40%. If they find aggravated fraud, the penalty is 60%.

Tax defaulters can face other consequences such as wage garnishment, or negative notes on Norwegian assets such as bank accounts or credit records, which impedes a company’s ability to do business in the country.

Why Norway's VAT Compliance Is Challenging

Norway VAT compliance is one of the most challenging SaaS and digital product sellers might face for a few reasons.

High Administration Difficulty (4/5)

- Complex documentation requirements – If grossing more than 50,000 NOK (about $5,000 USD or €4,500 EU) in any 12-month period in Norway, this paperwork-heavy process requires turning over all transactions and invoices bi-monthly.

- Local representative required – A local representative with power of attorney for your business is required if you don’t have a presence in the country. More than just a figurehead to appease tax authorities, this representative handles and oversees your Norwegian transactions.

- Punitive fines and penalties for noncompliance – Fines for failing to file and pay VAT start at 657 NOK (about $66 USD) per day and grow from there. Norway strictly enforces VAT compliance.

- Language requirements and barriers – Invoices must often be issued in accepted languages (generally Norwegian or English), creating an additional language barrier for some companies.

Norway Outside the EU OSS Program

Because it isn’t part of the EU’s OSS Program, Norwegian VAT must be charged, filed, and remitted separately. This creates additional compliance headaches for busy businesses who may have just a small tax team or none at all.

But that’s where Sphere comes in.

How Sphere Simplifies Norwegian VAT Compliance

.png)

Automated Monitoring and Registration

Sphere tracks your Norwegian revenue in real time, alerting you long before you cross the 50,000 NOK threshold. Even better, Sphere registers for you, whether you need the Standard VAT or the VEOC application. They also pair you with Sphere’s in-house Norwegian fiscal representative so you don’t need to seek out and hire your own local support.

Real-Time Tax Calculation

By integrating directly with your billing solution, Sphere identifies the customer’s location at checkout and applies the right VAT rate–whether that’s 25%, 15%, or 12%--at checkout. It also applies the reverse charge mechanism when a valid Norwegian VAT ID is supplied.

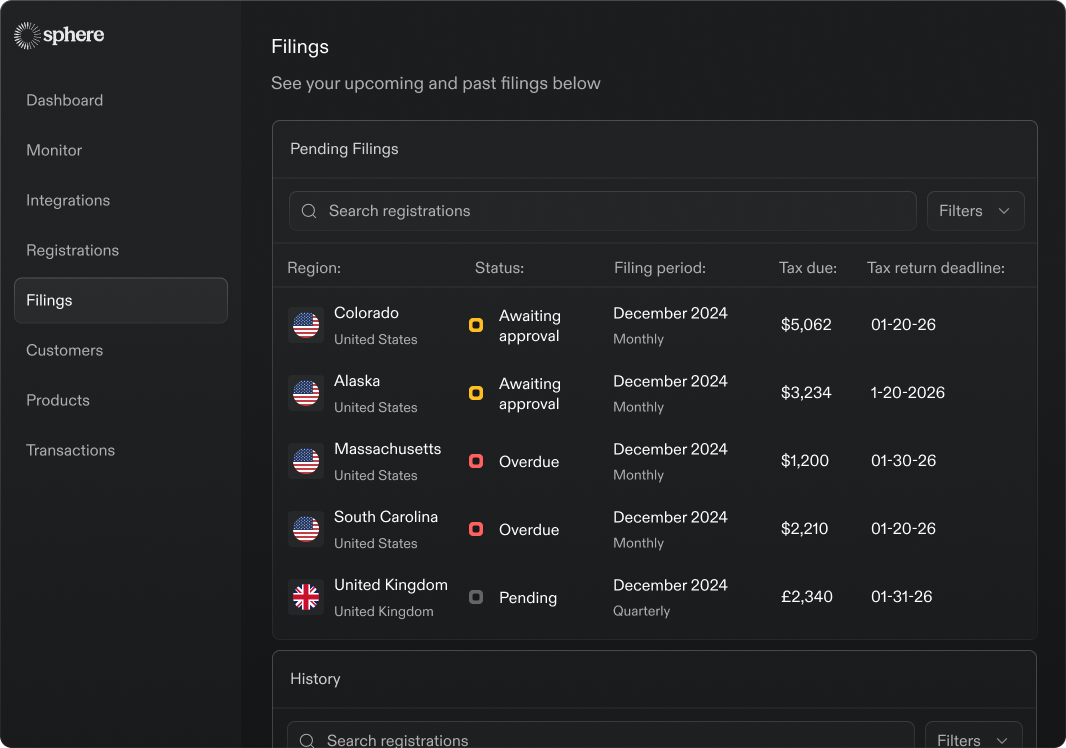

Automated Filing and Remittance

Forget calendar reminders and manual spreadsheets. Sphere generates the bi-monthly Standard VAT return or the quarterly VOEC report from your live transaction data, submits filings electronically in Norwegian-compliant formats, and initiates secure wire payments to the Tax Administration on the due date. Confirmation receipts are stored in your dashboard for instant retrieval during audits.

Scale to Norway Without Compliance Headaches

While Norway offers a lucrative market for SaaS companies, its VAT system is unduly complex. Sphere takes VAT threshold monitoring, registration, calculation, filing and remittance off your plate so you can focus on what you do best: building your business.

.png)

.png)