Tax Review and Assessment Model

The AI Native Tax Engine

We have completely rebuilt the tax engine with AI at its core. TRAM is the world’s first AI-native tax engine that collects, codifies and monitors tax information globally.

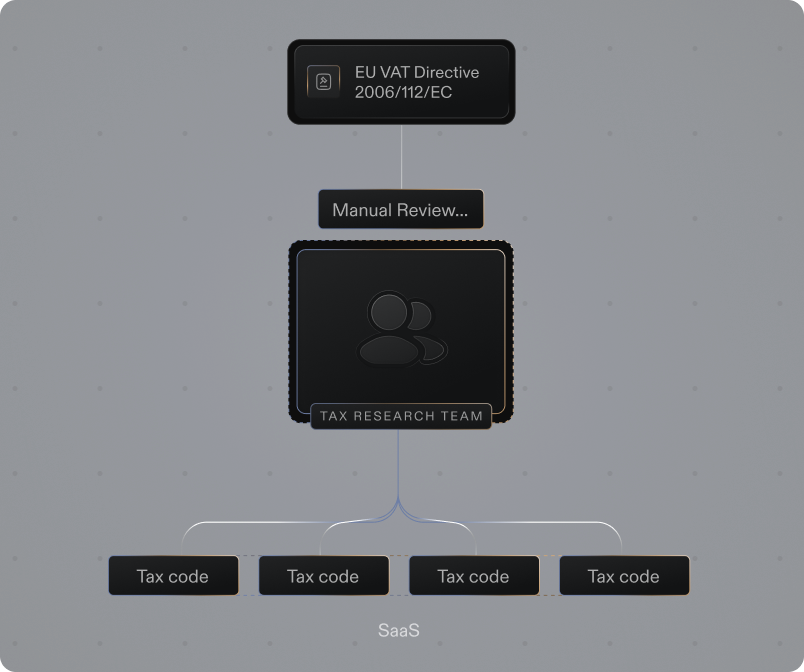

How tax research is done today

Tax research is currently done manually by large tax content teams. They review tax law in each jurisdiction on a periodic basis and make manual changes to their taxonomies over time. The process is inefficient, slow and prone to error.

Doesn’t update for changes in law/rates

Prone to error

Can’t provide global granularity

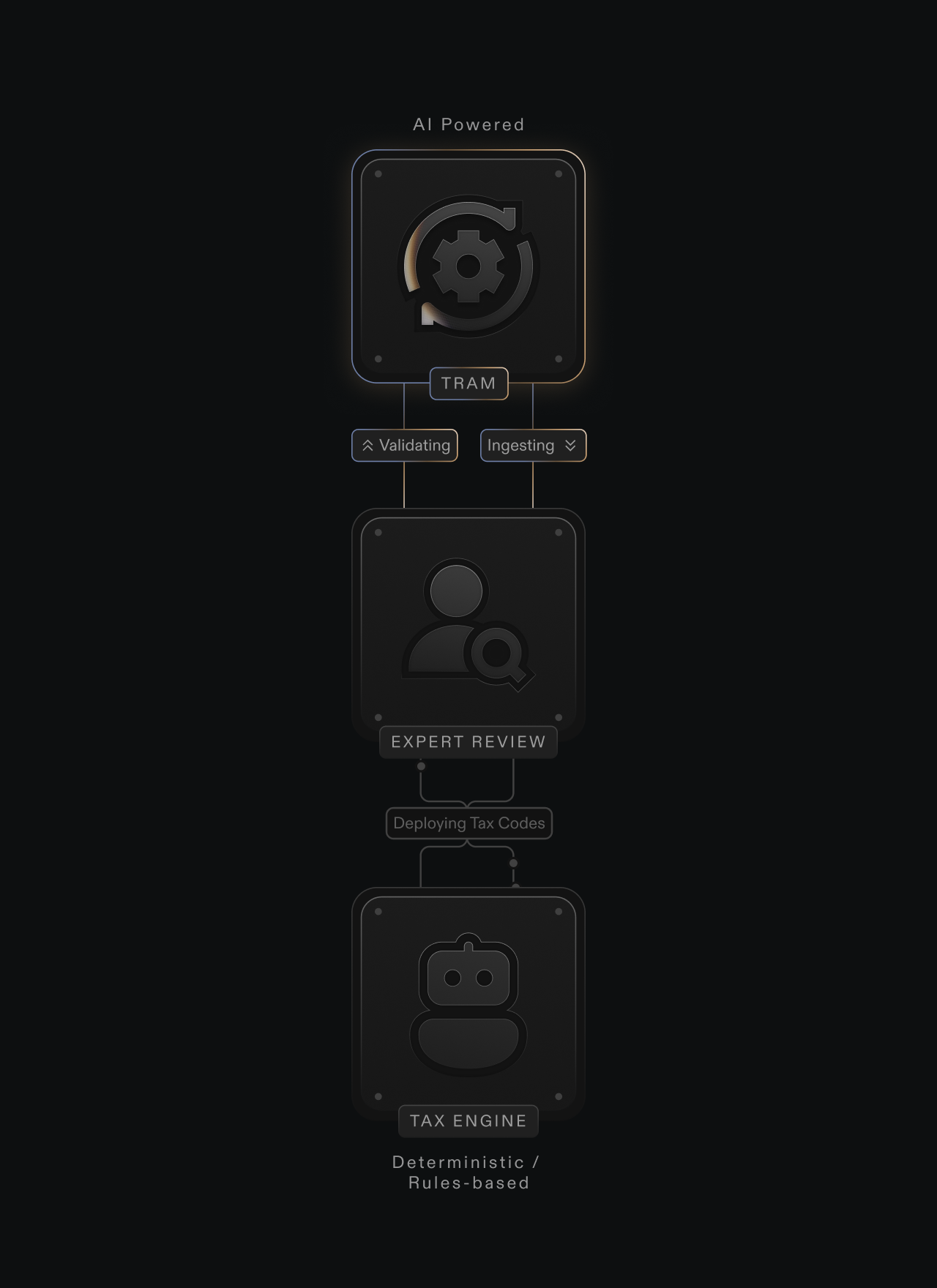

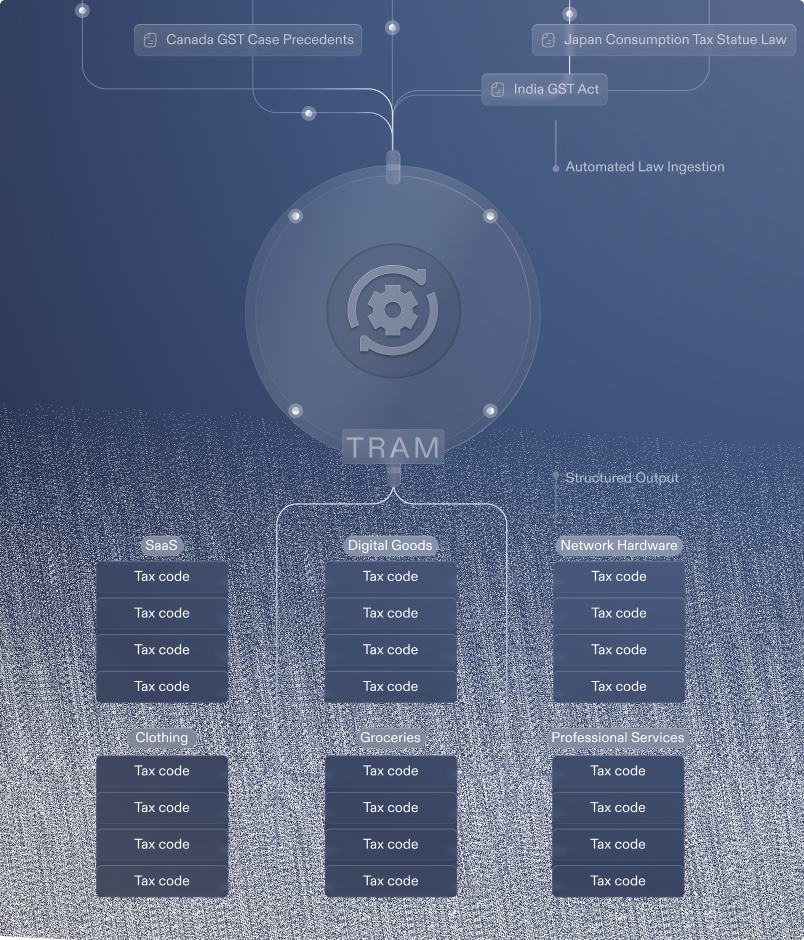

TRAM

TRAM collects, codifies and monitors tax law globally. This allows Sphere to expand rapidly across product categories and regions as well as always keep our tax code taxonomies accurate and up to date.

Continuously updated for changes in law and rates

Granular accuracy (that can be overridden)

Global coverage and scale

Guardrails for hallucinations

TRAM makes sense of global tax law at scale but its outputs are always reviewed by expert tax researchers. Their feedback increases TRAM’s accuracy ratings and makes it more efficient over time. Once outputs are approved, our determinations are pushed into our rules-based, deterministic tax engine which adds tax to your transactions in real-time (with zero risk of hallucination).