Mexico is notorious for one of the world’s most complex tax compliance processes. The administrative burden is so high that only about 270 tech companies have ever successfully registered for IVA in Mexico's history.

If you’re a fast growing technology company hoping to expand into Mexico, be prepared for difficult tax laws, months of paperwork, in-person requirements, and a maze of bureaucracy. But if Mexico’s population of 130 million is your next big growth opportunity, this guide breaks down IVA compliance from registration to filing.

IVA in Mexico Explained: Rates, Rules, and What’s Taxed

Quick Definition

Impuesto al Valor Agregado (IVA) is Mexico’s value-added tax. It applies to most purchases, including goods, services, and imported goods. Mexico’s standard IVA rate is 16%.

IVA Tax Rates and Regional Variations

Mexico has three main tax rates:

- 16% standard rate that applies to most goods and services, including all SaaS and digital services

- 8% border region reduced rate available in certain Southern and Northern border zones for certain goods and services

- 0% zero-rated category for exports, basic foods, medicine, and agricultural products

The border zone program exists to boost economic activity in frontier regions. It covers municipalities within 20 kilometers of the US border and parts of Baja California. It rarely applies to digital services.

What’s Taxed and What’s Exempt

It’s important to understand the difference between “zero-rated” and “exempt” transactions in Mexico.

With zero-rated transactions, you can claim input tax back. Zero-rated transactions include:

- Exports

- Basic food items like bread, milk, and eggs

- Medicine and medical devices

- Agricultural products and equipment

With exempt transactions, you cannot claim input tax back. These include:

- Residential real estate sales

- Life and health insurance

- Educational services

- Cultural and artistic events

- Public transportation

How IVA Applies to SaaS and Digital Services

In Mexico, SaaS and digital services are fully taxable at the 16% general rate. Further, there is no reverse charge mechanism that might offer some relief for unregistered B2B businesses. Any foreign company selling SaaS, digital goods, or cloud services to Mexican customers is responsible for registering for IVA.

IVA Registration Requirements for Foreign Companies

Does My Company Need to Register for IVA?

Yes, if you are selling SaaS or digital services to anyone in Mexico. The law requires registration within 30 days of your first sale. There is no minimum threshold. Even one $10 subscription triggers the need to register.

Required Documents and Process

Mexico’s registration process is notoriously complex. You’ll need the following items:

- Articles of incorporation and bylaws (apostilled and translated by a certified Spanish translator)

- Tax ID from your home country (apostilled, ideally a Tax Residency Certificate)

- Proof of company address

You’ll also need a legal representative on the ground. This person must:

- Be a Mexican taxpayer with an active RFC (tax ID)

- Have a Power of Attorney (apostilled, notarized in Mexico, translated to Spanish)

- Also have a personal RFC and proof of Mexican address (bank statement or utility bill)

It’s important to note that most registration takes place in-person in Mexico, so your in-country representative is vital.

How the RFC System Works

The Registro Federal de Contribuyentes (RFC) is Mexico's taxpayer identification system. Your company will need an RFC for:

- Issuing valid invoices (CFDIs)

- Filing monthly returns

- Opening bank accounts

- Processing payments

- Dealing with SAT (Mexican tax authorities)

Your legal representative also needs their own RFC. They'll use it to act on your behalf, sign documents, and submit filings.

Barriers to Entry and Common Frustrations

Only about 270 tech companies have successfully registered in Mexico for a good reason.

The appointment system is broken, with waits of months for appointment times. Everything needs translation and an apostille (official stamp), and there’s no English support. All official business is required to be conducted in person. And the administrative rules can change quickly, with no warning.

Be prepared for a long-haul when doing business in Mexico.

Calculating and Charging IVA Correctly

SaaS companies generally charge 16% on everything. The 8% border rate and 0% rates don't apply to digital services.

Invoicing and e-Invoicing (CDFI)

Mexico pioneered the concept of e-invoicing. Their electronic invoices require:

- Your RFC and your customer's RFC (or generic RFC for consumers)

- Date, time, and place of issue

- Detailed line items with descriptions

- IVA shown separately (never included in the price)

- Digital signature using your e.firma

- Unique folio number from SAT (the Mexican taxing authority)

B2C sellers can use a “fractura global.” This is one consolidated invoice per day covering all consumer transactions. This saves a company that may make thousands of transactions per day, from transmitting thousands of e-invoices.

For B2B sales, each customer needs their own CFDI with their RFC. They'll use these for their own tax deductions and IVA credits.

All CFDIs must go through an authorized Proveedor Autorizado de Certificación (PAC) provider who validates and timestamps them with SAT.

Charging IVA on B2B vs B2C Sales

Both B2B and B2C sales are taxable at 16%.

Unlike most countries, Mexico doesn’t have a reverse charge mechanism for digital services. This means you must charge and collect IVA from every customer, even large enterprises who might be used to self-assessing when dealing with other countries.

B2B customers will want proper CFDIs (invoices) with their RFC number so they can claim input tax credits. B2C customers usually don't care about invoices unless they're expensing purchases.

Filing VAT Returns and Remitting Tax in Mexico

Monthly Filing Requirements

Mexico requires monthly filing. Returns are due on the 17th day of the month following the end of the taxable period. They require that you report on a cash basis (i.e. what you collected, not what you invoiced.) And even if you make no sales, you’re required to file a nil return. Reporting is done through SAT’s portal using your e.firma (e-signature). And it’s important to note that all filing must be done in Spanish.

The return itself includes total sales, IVA collected, any input tax credits (rare for foreign digital services), and the net amount due.

Tax Refund Eligibility and Common Roadblocks

Businesses making zero-rated sales or who have excess input tax can apply for an IVA refund. But note that SAT scrutinizes every refund request, and the documentation requirements are extreme. When successful, the refund process can take from 40 days to multiple months. But refunds are often not granted, with companies waiting years without success. Worse, a refund request may also trigger an audit, especially with foreign companies. In reality, most foreign SaaS companies carry credits forward rather than fight for refunds.

Mexican Bank Accounts and Payment Requirements

IVA payment must be made in Mexican pesos (MXN) through a Mexican bank account. This can get tricky fast, but you have several options:

- Open a Mexican bank account. Note this is nearly impossible without Mexican incorporation

- Use an authorized intermediary. This is an expensive but viable alternative to a Mexican bank account.

- Work with a payment processor. This comes with high fees.

SAT often rejects or flags accounts for audit when they use cross-border wire payments. It’s vital to use Mexican banking infrastructure to make your IVA payments.

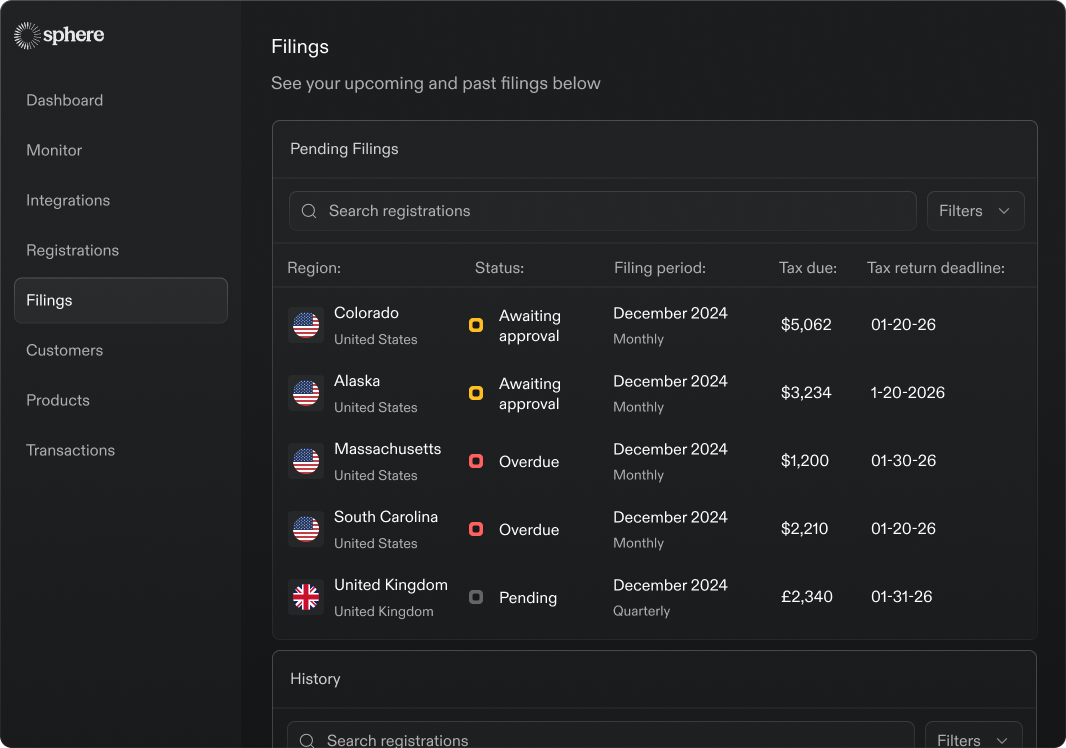

How Sphere Simplifies IVA Compliance in Mexico

End-to-End Tax Support

.png)

Sphere handles the entire IVA cycle so you don’t have to navigate Mexico’s complicated tax system. With Sphere, you get:

- Real time IVA calculation

- Automatic CFDI (invoice) generation and SAT submission

- Monthly return preparation and filing

- Ongoing compliance monitoring

Sphere integrates directly with SAT's systems, eliminating manual work and reducing errors.

Skip the Bank Account and Local Headaches

But the best part? Sphere remits your IVA payments in MXN without requiring you to open a Mexican bank account. Sphere provides:

- Legal representative services included

- Mexican address for official notices

- Complete infrastructure for SAT communications

- Currency conversion and remittance handling

- Full audit trail for compliance

You sell into the large and lucrative Mexican market, Sphere handles everything else.

One Platform for Global Compliance

Mexico is just the beginning. Sphere's AI-powered platform manages indirect tax compliance across 180+ countries from a single dashboard. As you expand into Brazil, Colombia, or any other market, you're already set up. No new vendors, no additional complexity.

Sphere provides:

- Consolidated global tax reporting

- Audit-ready documentation

- Automatic updates for changing laws

- Unified compliance calendar

- Real-time nexus monitoring

Don’t Let IVA Hold You Back. Make It a Growth Lever

Mexico IVA compliance is complex, but don’t let that stop you from accessing 130 million new customers. Done right, proper IVA compliance actually improves customer trust, enables enterprise sales, and reduces audit risk.

The companies that have successfully navigated Mexican tax compliance understand one thing: you can either spend months figuring it out yourself, or you can automate it from day one. With only 270 tech companies having ever completed IVA registration, you'll be joining an exclusive club that has access to Latin America's second-largest economy.

The Mexican market is waiting. The only question is whether you'll tackle IVA compliance the hard way or the smart way.

.png)

.png)