.png)

SaaS companies quickly outgrow Anrok's US-only focus and unpredictable pricing. If you're evaluating alternatives, this guide breaks down the top 6 Anrok competitors based on automation capabilities, pricing transparency, and global tax support.

The right sales tax software can save your team hours of manual work while avoiding costly audit risks. Let’s dive into the pros and cons of each platform and which one fits your business best.

What Is Anrok and Who Is It For?

Overview

Anrok is a sales tax automation platform built specifically for SaaS companies operating in the United States. The platform handles real-time tax calculations and integrates with popular tools like Stripe, NetSuite, and QuickBooks.

The company has raised significant venture funding and targets SaaS businesses selling digital products across multiple US states. Their clean interface and developer-friendly API make implementation straightforward for technical teams.

Key Features

Anrok monitors economic nexus thresholds automatically and alerts you when you're approaching registration requirements in new states. The platform handles automated filings and maintains calculation accuracy across jurisdictions.

The user interface is notably modern compared to legacy solutions. Developers appreciate the well-documented API that integrates smoothly with modern tech stacks.

Pricing and Limitations

Here's where things get tricky. Anrok charges a platform fee plus 0.3-0.4% of your revenue. This percentage-based model means your costs balloon as you grow. This makes pricing unpredictable for scaling SaaS companies.

International coverage also isn’t native to the platform. Anrok outsources VAT and GST compliance through partner networks, creating complexity when your business expands globally. The platform also only covers sales tax, leaving you to find separate solutions for input tax, withholding taxes, and e-invoicing.

Customers have also noted that customer support is primarily ticket-based, and that tax content updates rely on manual research by internal tax experts rather than fully automated AI-driven monitoring.

Why Companies Look for Anrok Competitors

Hidden Costs

Revenue-based pricing might sound like a good deal at first. That’s until you’re processing millions of sales. A company making $10 million annually could pay $30,000-$40,000 just for tax software. Meanwhile, competitors offer flat or tired pricing that won’t eat into your profit margins.

Limited International Functionality

Managing global tax through a network of 3rd parties creates a maze of contracts and systems. You’ll juggle multiple dashboards, manually reconcile data between platforms, and coordinate with different support teams. Businesses with global operations often prefer platforms that provide native international tax coverage.

Manual Processes

Tax rules change constantly. Anrok's manual update process means waiting for human teams to implement changes. AI-powered platforms update rules automatically, reducing errors and delays.

Support Bottlenecks

Ticket-based support means waiting hours or days for answers. When you're dealing with tax deadlines or urgent compliance questions, that wait time isn't acceptable. Modern platforms like Sphere offer Slack integration or direct expert access for immediate help.

Anrok vs Competitors: At-a-Glance Comparison

The 6 Best Anrok Competitors

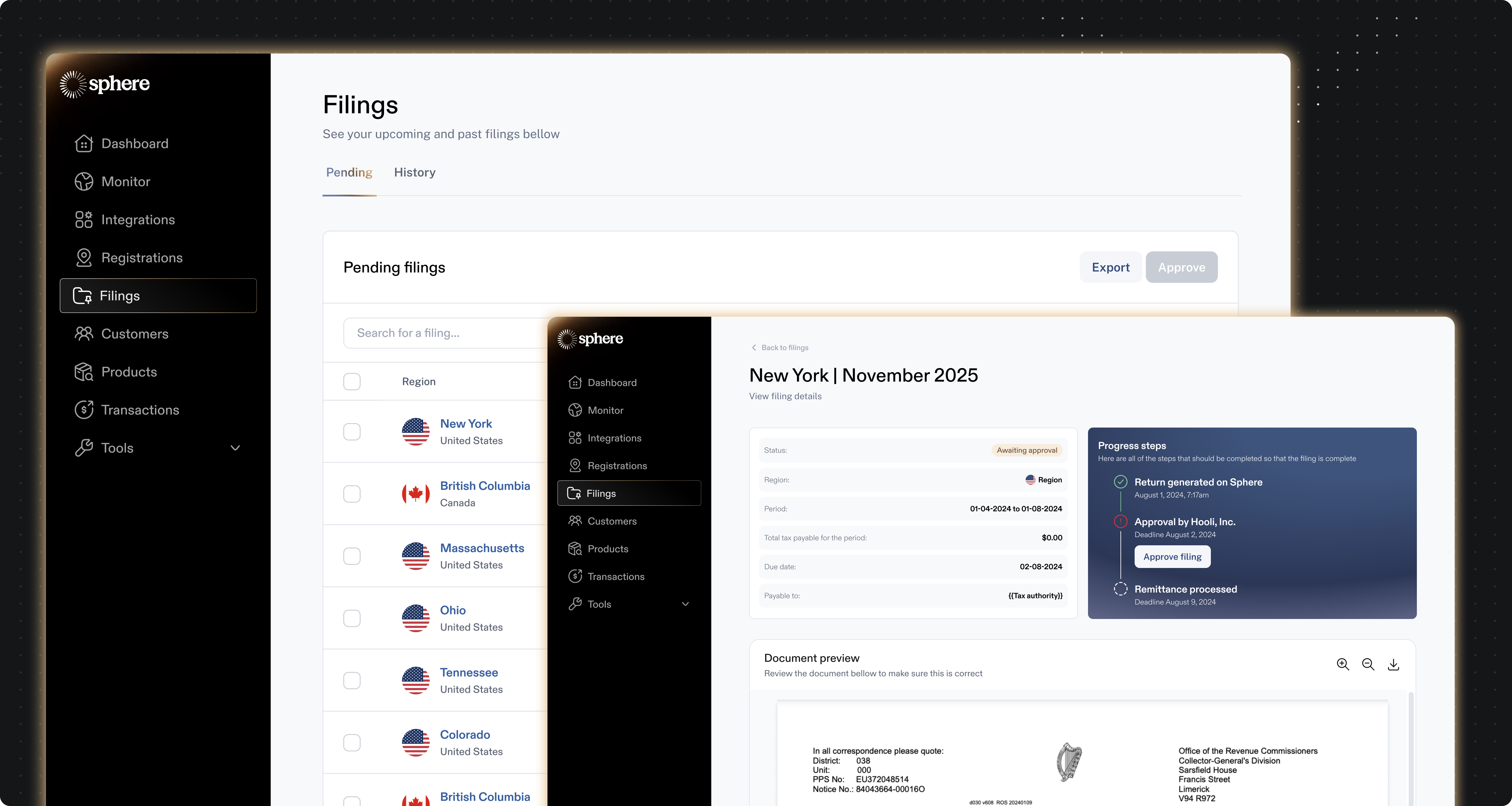

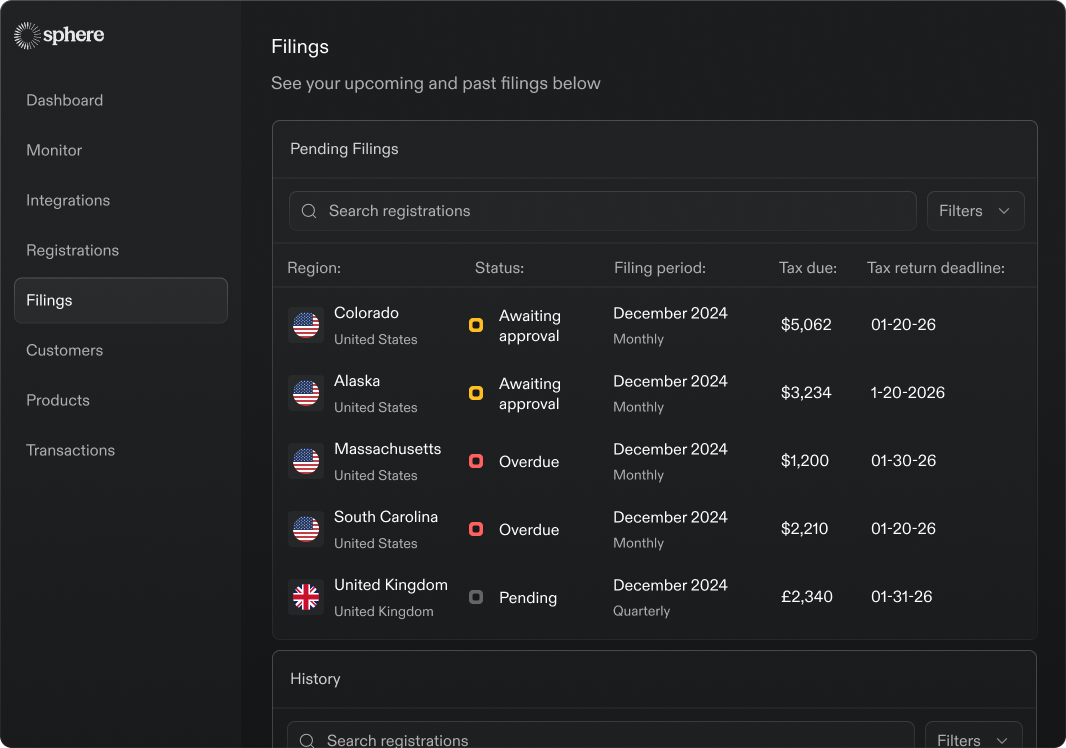

1. Sphere – AI-Powered Global Tax Platform

Sphere takes a fundamentally different approach with its AI-native engine. The platform automates registration, calculation, filing, and remittance across 100+ jurisdictions without human intervention.

The platform connects directly with tax authorities worldwide, meaning no supervising third-party middlemen. Sphere handles everything indirect tax and related, including:

- Sales tax

- VAT

- GST

- Input tax

- Withholding taxes

- E-invoicing

- Tariffs

Support runs through Slack with 24/7 access to tax experts.

Unlike Anrok, pricing is refreshingly simple: $100 per region per month. No revenue percentages, no hidden fees, no surprise overages. Your costs stay predictable whether you're doing $1 million or $100 million in sales.

Setup takes minutes, not months. Companies like ElevenLabs and Replit switched to Sphere specifically for the predictable pricing and true global automation.

2. Avalara – The Legacy Enterprise Option

Avalara dominates the enterprise market with deep US coverage and extensive integrations. Their platform handles complex tax scenarios and connects with most major ERPs.

The downsides? Implementation can take 3-6 months and cost six figures. Pricing is also opaque. You’ll negotiate custom contracts with usage limits that trigger overage fees. International filings get outsourced to third parties, creating coordination headaches.

Avalara customers frequently complain of customer support pain. Response times stretch for 24 hours to weeks. For a platform this expensive, the drawbacks are hard to justify.

3. Vertex – Deep ERP Integration, High Complexity

.png)

Vertex is the ideal solution for Fortune 500 companies running Oracle or SAP. The platform offers sophisticated tax logic and handles complex corporate structures.

But that sophistication comes with a price. Vertex’s customized implementation takes months and extensive technical resources. And the steep price reflects that complexity. Further, you’ll pay for ongoing maintenance both with Vertex and in the dedicated tax team that it takes to manage your Vertex integration.

If your business is not a massive enterprise with complex indirect tax requirements, then Vertex is overkill for your business.

4. Stripe Tax – Simple Tax for Stripe-Only Sellers

If your business processes payments exclusively through Stripe, then Stripe tax is your easy tax collection option. You won’t need a separate integration or complicated set up because tax is built right in.

But Stripe tax only calculates and collects tax on your behalf. You’ll still have to file returns, remit tax to taxing authorities, and register when you have jurisdiction in a new state or country. The price is a 0.5% transaction fee that can add up quickly as your business scales. And customers complain that there’s no human support, only a self-service knowledge base.

If you run a simple Stripe-only business with tax in one or two jurisdictions, Stripe Tax may be sufficient. But as your business grows, you’ll quickly outgrow this simplified tax solution.

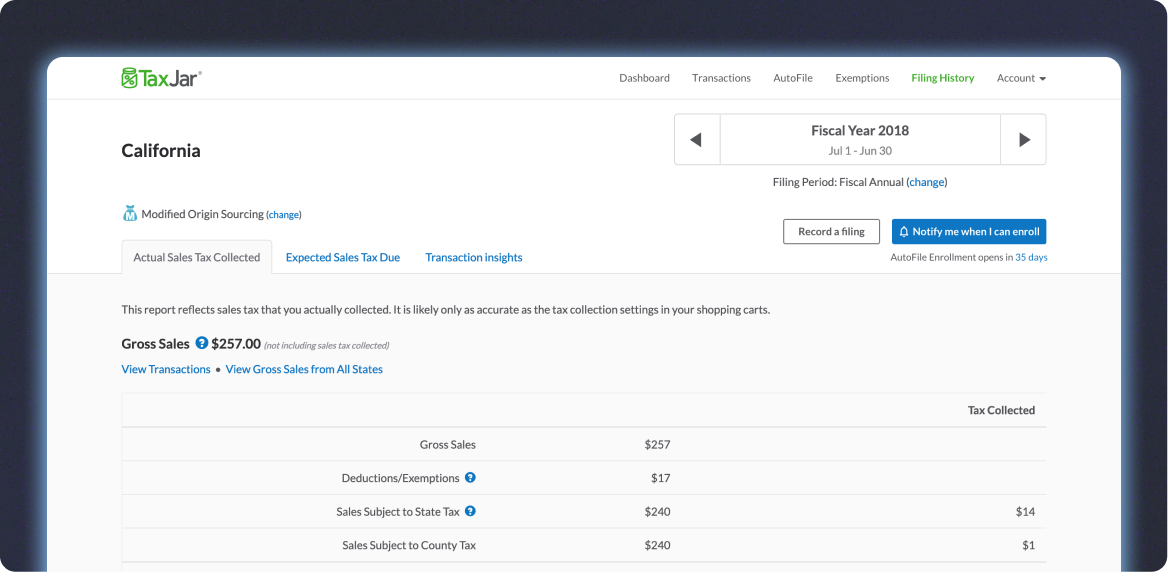

5. TaxJar – US-Only Automation for SMBs

.png)

TaxJar calculates, collects and files US sales tax with its AutoFile feature. Setup is straightforward, and their tiered pricing based on number of transactions offers predictability for your budget.

But the platform stops at US borders. It doesn’t offer VAT or GST support at all. Customer satisfaction has also declined since Stripe’s acquisition of the platform, with users reporting slow support and fewer product updates.

TaxJar works for US-only small businesses, but lacks the sophistication for scaling, especially internationally.

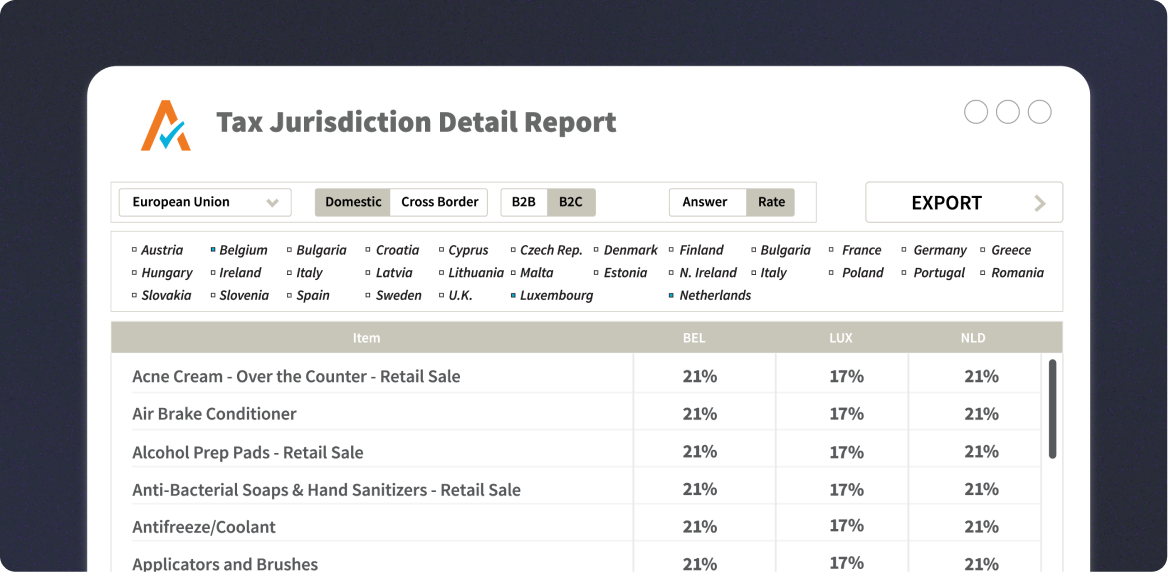

6. Numeral – Flat-Fee Compliance for US-Based Businesses

.png)

Numeral offers 24/7 support and a clean, modern interface that users actually enjoy using. The platform also charges a flat $75 per tax return, making costs completely predictable.

But it’s important to note that Numeral’s focus is primarily on e-commerce rather than SaaS. While there is international functionality, similar to Anrok it requires partnering with 3rd parties. But if your business is US-only, e-commerce-focused, and you want predictable pricing, Numeral delivers.

Choosing the Right Tax Compliance Partner

Your tax solution should fit your company’s current stage and future goals.

For startups with simple needs Stripe Tax, TaxJar, and Numeral handle the basics without breaking the budget. Note that TaxJar and Numeral are both US-only, and that Stripe only handles tax calculation and collection, not registration, reporting or filing.

For scaling SaaS companies Sphere offers the best combination of automation, native global coverage, and predictable pricing. You won’t need to switch platforms as you grow internationally.

For large enterprises, Vertex or Avalara can handle complex tax requirements, assuming your business has the budget and technical team required to implement these costly solutions.

Before choosing a tax partner, consider where you’ll be in two years. Will you expand internationally? Will revenue-based pricing become cost-prohibitive? Do you want to automate or do you predict being able to handle manual processes even as tax rules and laws change?

Cost predictability and automation level should be your primary decision factors. The market is shifting away from percentage-based pricing and manual tax management for good reason.

The Bottom Line: Automate, Scale, and Stay Compliant

The tax compliance landscape is evolving rapidly. Manual processes and US-only solutions can’t keep pace with modern SaaS growth.

Sphere represents the future of tax automation. It’s AI-powered, transparently priced, and features global tax compliance natively. While Anrok helped establish the SaaS tax category, the next generation of platforms delivers true automation without limitations.

Your tax compliance shouldn't hold your business back. Choose a platform that scales with you, not one that penalizes your success with percentage fees.

.png)