.png)

Singapore is an attractive market for global businesses. As the economic powerhouse of Southeast Asia, it holds consumers with serious purchasing power. And better yet, they are eager digital adopters. But, for businesses looking to enter this lucrative market, Singapore’s complex Goods and Services Tax (GST) system can be a massive barrier.

The current GST rate is 9%. Both foreign and local companies can trigger registration requirements, and the rules change depending on whether you’re selling B2B or B2C.

This guide explains what you need to know about Singapore’s registration thresholds. It covers the two different GST systems, filing schedules, payment methods, and how automation can help you avoid compliance problems.

Who Needs to Register for GST in Singapore?

The $1M Global Sales Threshold

A company meets Singapore’s GST threshold when you sell to customers in the country and hit SGD 1 million (about $740,000 USD) in global turnover in any 12-month period.

GST is required when you sell “taxable supplies” to customers in Singapore. These include SaaS subscriptions, digital downloads, cloud services, and any other digital products or services.

The threshold also applies to both B2C and B2B sales, though the actual tax treatment differs between them.

The Two GST Regimes: Regular vs OVR

Singapore has two paths to registration, the regular GST regime and Overseas Vendor Registration (OVR).

Regular GST Regime

This registration type applies to businesses local to Singapore or those that have a permanent establishment in the country.

To register this way, you’ll need a local tax agent. This registration type lets you reclaim input tax credits. However, it has more complex compliance rules. These include detailed reporting duties.

Most digital businesses selling from abroad stick with the simpler OVR scheme.

Overseas Vendor Registration (OVR)

This is the Singapore GST registration option for businesses that sell to buyers in Singapore but have no physical presence in the country.

OVR is much simpler than regular GST, however your business will not be allowed to claim input tax credits if registered this way.

The upside with the OVR scheme is that no local representative is required, and the reverse charge applies if you’re selling B2B.

Register using the OVR method at the IRAS registration page.

GST Compliance for Digital Sellers: From Setup to Filing

Getting Started with Registration

No matter what method you choose, registration for Singapore’s GST is a complex task. You’ll need the following documents and information:

- Certificate of incorporation

- Passport copies for all directors and business owners

- Signed declaration forms from each director/owner

- Detailed business activity descriptions

- Financial statements showing you've crossed the threshold

When registering for the OVR, you’ll start with the OVR registration form. When registering for regular GST, your local representative will help you register through the MyTax IRAS portal.

Setting Up CorpPass and myTax

One your Singapore GST registration is approved, you’ll need to do two additional things:

- Set up a CorpPass account to obtain your digital business ID

- Link your digital business ID to the MyTax IRAS for filing your GST returns

This process is frustrating because each system has its own login, verification requirements, and quirks. Documentation from IRAS often assumes you're familiar with Singapore's government systems, which you're probably not. Fortunately, Sphere’s tax automation solution handles these technical steps so your Singapore GST registration and setup is seamless.

Charging GST on Your Transactions

Singapore’s GST rate is 9%. For B2C sales, you simply charge that 9% on all taxable transactions. Be sure to show the GST on tax invoices and include the phrase “inclusive of GST” in the pricing.

For B2B sales, the reverse charge mechanism applies. In this case, if your business buyer is registered for Singapore GST, you won’t charge the tax. Instead, your buyer accounts for the tax they would have paid on the transaction and includes it on their own tax filing. Before assuming reverse charge applies, be sure to verify your customer’s GST registration status. And always keep documentation of reverse charge transactions in case of audit.

What Is and Isn’t Taxable Under Singapore GST

Taxable, Zero-Rated, and Exempt Goods & Services

Singapore classifies goods and services by three types of taxability: standard, zero-rated and GST exempt.

Standard GST Transactions

Most digital goods are taxable at the standard 9% GST rate. These include:

- SaaS subscriptions

- Digital downloads (software, music, ebooks)

- Cloud computing services

- Streaming services

- Online courses and training

- Digital advertising services

Zero-Rated Transactions

Exports and sales of international services to buyers outside of Singapore are considered “zero-rated.” This means that while GST still technically still applies. 0% is charged on the transaction. However, even though no tax is charged, businesses registered through Singapore’s standard tax regime can still claim input tax credits on zero-rated goods.

GST Exempt Transactions

These transactions are exempt from GST:

- Most financial services

- Sale or rental of residential properties

- Investment precious metals

- Digital payment tokens (certain cryptocurrencies)

No GST should be charged on these transactions, but input tax credits also do not apply here.

Examples of How GST Applies

GST treatment depends on your customer's location, their GST registration status, and how you deliver your service.

Let’s look at some examples:

- A Singapore customer purchases a SaaS subscription from you: You charge the standard 9% GST

- A US company purchases your software: This is a zero-rated export. You’d charge 0% GST and still report the sale on your GST returns

- You sell into Singapore via an app where the platform, not your company, is deemed the “supplier”: The platform, like Amazon or Google Play, generally collects the tax

- You sell low-value goods under SGD 400: If registered, these items are still taxable at the standard rate. While there is low-value goods relief in Singapore, it doesn’t apply to registered vendors

Filing Your Singapore GST Returns (and Paying Them)

Filing Schedules and Formats

GST returns must be filed quarterly through either Form F5 (OVR regime) or Form F8 (Regular GST regime). They are due one month after the end of the quarter.

File via the MyTax IRAS portal. You’ll need to include:

- Total output tax collected

- Total value of taxable supplies

- Zero-rated supplies value

- Exempt supplies (if any)

- For Regular regime: input tax claims

The myTax portal requires specific formatting and won't accept returns with errors. Common mistakes include misclassifying B2B sales, applying zero-rating incorrectly, and making math errors between sections.

How to Pay Your GST Bill

Singapore requires international wire transfers with exact payment references. Payment options depend on your location.

Paying from Singapore-based accounts

Local companies can pay via the following methods:

- GIRO (automatic debit)

- FAST transfer to DBS

- Internet banking

Payment options for international companies

International companies must pay via wire transfer and use the following exact details:

- Payee: Commissioner of Inland Revenue

- Account Type: DBS Current Account

- Account No.: 0010468669

- DBS Swift Code: DBSSSGSG

- Payment Reference: Your exact GST account number followed by "GST"

That payment reference field is critical. IRAS receives thousands of payments daily, and without the correct reference, your payment could take a month to process and post to your account. At the same time, you are getting late payment penalties.

Fortunately, Sphere automates Singapore GST filing and payment. This means your business does not have to deal with a complex online portal or making detailed payments.

Exemptions, Rebates & Support for Singaporeans

Rebates and GST Voucher Scheme

Singapore offers GST rebates to lower income households. These include cash payouts, utility rebates, and MediSave (national health insurance) credits. However, this doesn’t affect your business obligations. You’re still required to collect and remit the entire 9% on B2C sales.

Common GST Exemptions and FAQs

Some items are considered tax exempt and thus outside the GST system. These exempt supplies include:

- Residential property rental

- Certain approved education courses

- Financial services

- Payment processing

- Currency exchange

Note that financial software, however, is still taxable.

Common questions about imports, free trade zones, and customs duties often come up, but for digital services, you're mainly dealing with the standard GST rules rather than import regulations. Digital businesses working remotely usually do not have to follow the annual value of goods, property tax rules, or Singapore customs requirements.

What Challenges Should You Prepare For and How to Avoid Penalties

Top GST Mistakes to Watch Out For

The biggest mistakes companies make involve timing, customer classification, and assuming Singapore's system works like other countries they know. These errors can trigger significant penalties and unwanted attention from IRAS.

Missing registration timing is perhaps the most expensive mistake. Companies often fail to track their global revenue against the SGD 1 million threshold, waiting until they have what they consider "significant" Singapore sales. Others assume they need physical presence to have tax obligations. By the time they realize their error, they're already non-compliant and facing backdated penalties.

Errors in classifying customers cause ongoing problems. Not verifying B2B customers' GST registration status leads to incorrect tax treatment. Some businesses apply reverse charge to businesses that are not registered. They also miss important document requirements.

Zero-rating mistakes stem from misunderstanding the rules. Companies assume all foreign sales are automatically zero-rated, but service location rules are more complex. If you do not have proper export documents, IRAS may change zero-rated sales to standard-rated. This can cause large unexpected tax bills.

Filing and payment issues round out the common errors. Late quarterly returns, incorrect payment references on wire transfers, and mathematical errors in returns all trigger penalties and increase audit risk.

Penalties and Audit Triggers

Singapore strictly enforces GST. Late registration nets a SGD 10,000 penalty, plus 10% interest on all GST that should have been collected. Filing errors trigger 5% penalties plus daily interest, and poor record-keeping almost guarantees an audit. Late filing penalties start at 5%, then add on 2% per month up to a 50% cap.

Several red flags can trigger an audit. These problems include inconsistent filing patterns, very high zero-rated sales percentages, missing or poor documents, and big changes to past returns.

Businesses should keep all documentation for five years or longer. Safeguard tax invoices, export and zero-rating proof documents, all GST calculations, and wire transfer payment confirmations to combat an audit.

Let Sphere Handle Your Singapore GST, From Start to Finish

How Sphere Simplifies GST for SaaS Teams

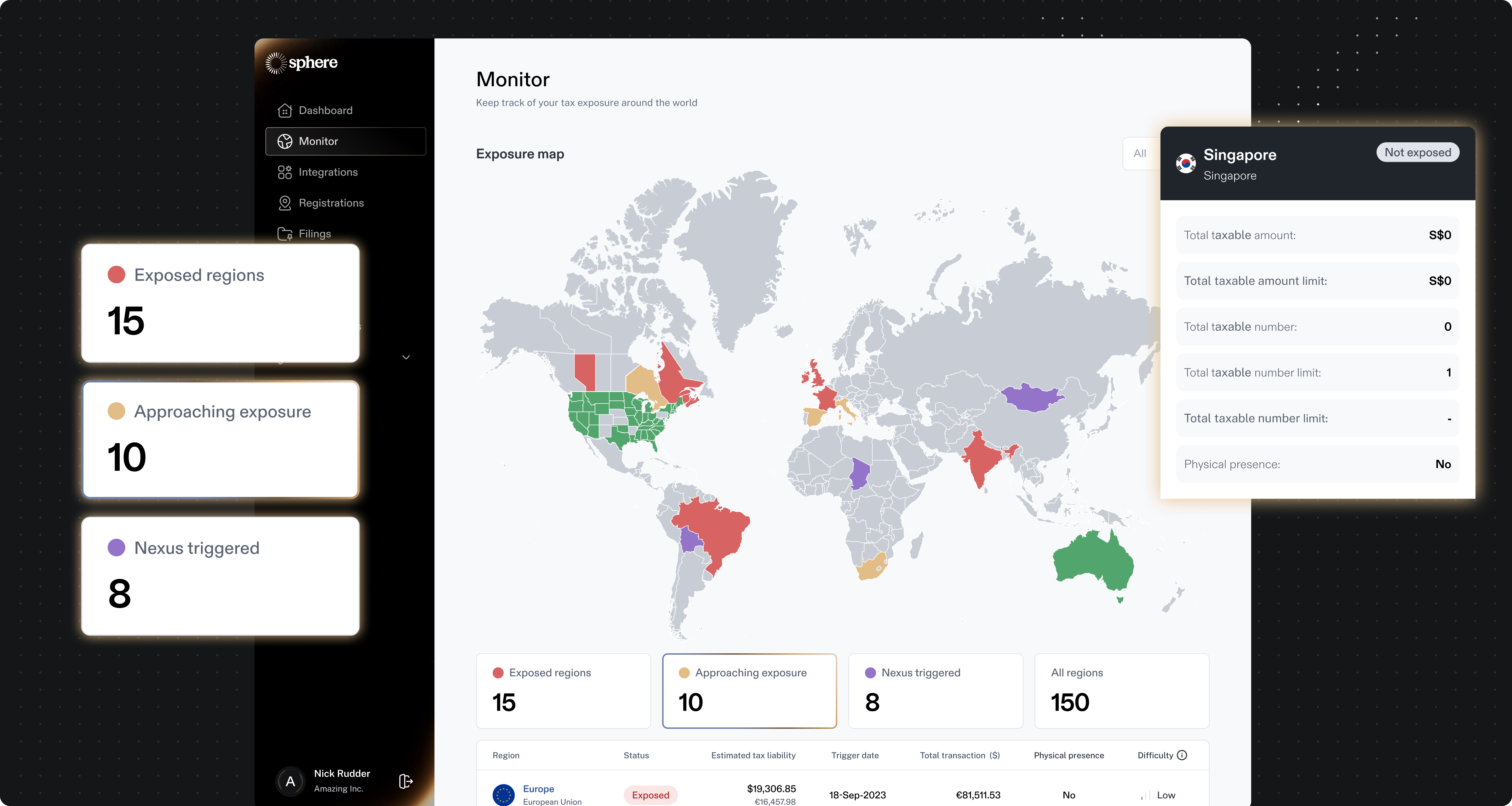

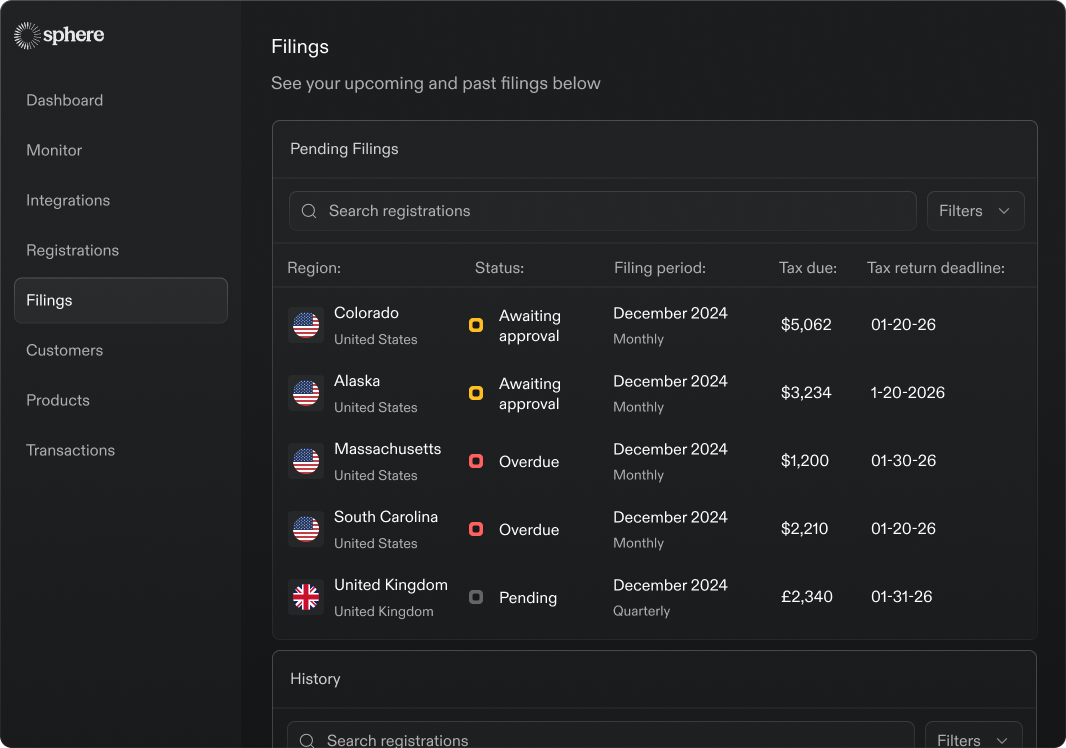

Sphere automates the entire Singapore GST lifecycle, from monitoring when you have liability in the country to filing returns to remitting payments.

The platform tracks your global revenue in real-time to monitor thresholds. It alerts you before you cross SGD 1 million. It calculates sales in Singapore separately. Registration support helps you choose between OVR or Regular regimes. It manages document preparation. It also handles the complex CorpPass and myTax setup process.

Automated calculations decide if each transaction is B2B or B2C. They apply the correct rates (9%, 0%, or exempt). They also handle reverse charge cases automatically. When it comes to quarterly filing, Sphere prepares Form F5 or F8 automatically, validates all data before submission, and files directly with IRAS through secure API connections.

Paying your GST is simple, too. Sphere manages wire transfer details, ensures correct payment references (critical for avoiding processing delays), and tracks payment confirmation from the IRAS system.

Built for Digital-First Companies

Sphere understands the unique challenges of software, digital products, and modern business models.

Digital product intelligence means the system understands subscription models. It handles marketplace transactions correctly. It also manages digital service classifications without manual setup. There’s no need to hire a local tax team or learn Singapore’s tax system.

The platform connects directly with your billing systems. It automatically pulls transaction data. It applies the correct tax treatment without manual work. Whether you use Stripe, Shopify, or custom billing systems, Sphere syncs seamlessly and maintains audit trails automatically.

GST in Singapore Is Manageable. If You Have the Right Tools

Singapore's GST system is complex, but not impossible.

Digital-first finance teams need three things to succeed: automation that actually works, clear visibility into their obligations, and confidence that they're compliant. Manual processes and spreadsheets won't cut it when you're dealing with multiple government portals, precise payment references, and quarterly deadlines.

Sphere delivers all three, turning Singapore GST from a compliance nightmare into a background process that just works.

.png)